Jared Kushner will lend $1B to developers over the next five years

When Charles Kushner founded real estate development firm Kushner Companies in 1985, he may have had visions of his son Jared taking over the company (which he did in 2007), but he never could have predicted the role his kin would have in one of the country’s most contentious presidential elections. Because of his political involvement, many have speculated what will come of the company, but Jared shows no signs of slowing down. In fact, the Post reports today that the firm plans to lend $1 billion over the next five years–or $200 million annually–to other developers’ projects through Kushner Companies’ new lending arm, Kushner Credit Opportunity Fund, which was launched earlier this year.

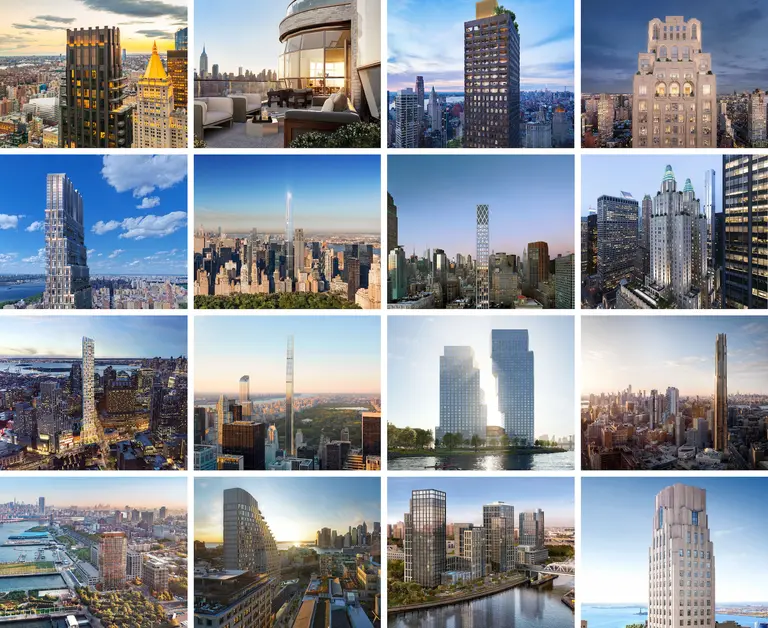

Currently, Kushner Companies’ portfolio consists of 20,000 multi-family, residential buildings, as well as 12 million square feet of office, industrial, and retail space. Their first foray into the financing business came in May when they bought the mezzanine debt on 9 DeKalb Avenue, JDS and Chetrit Group’s mixed-use tower in Downtown Brooklyn that will become the borough’s tallest building. According to sources, the $115 million mortgage was shared by Kushner and Fortress Investment Group. And just this past Monday, it was announced that Kushner loaned $33 million to Toby Moskovits’ Heritage Equity Partners’ new Bushwick project at 215 Moore Street that will bring 75,000 square feet of industrial, retail, and office space to the neighborhood.

Laurent Morali, who was hired in June as the new president of Kushner Companies, said of the investment plan, “We like the opportunity to deploy our capital in a different place in the capital stack. As a lender, we will look at the sponsor and the borrower and if it’s the type of project we could have done as an owner in a great area, it gives us more optionality.” Kushner Credit Opportunity Fund plans to lend not only in the greater New York area, but in Miami, Washington D.C., Boston, San Francisco, and LA.

[Via NYP]

RELATED:

- Spotlight on Jared Kushner, real estate wunderkind and unexpected presidential advisor

- Jared Kushner and LIVWRK Make Plans to Buy a Gowanus Property, Possibly for Luxury Condos

- Plans to Convert the Jehovah Witness Watchtower Complex Into a High Tech Incubator Revealed!