Photo by Danny Navarro / Flickr cc

Benefits of 421-a tax break extended to Gowanus developers

Learn more

Photo by Danny Navarro / Flickr cc

Photo of New York State Capitol by wadester16 on Flickr CC

Photo courtesy of Darren McGee/Office of Governor Kathy Hochul on Flickr

Photo by Patrick Tomasso on Unsplash

Brooklyn Point in Downtown Brooklyn offers 421-a benefits through 2045; Rendering by Williams New York

Photo via Flickr

Image courtesy of NYC Department of City Planning

Know of something cool happening in New York? Let us know:

Know of something cool happening in New York? Let us know:

555Ten, an Extell building that would be affected by the 421-a changes

On this past January 1, the 421-a tax abatement program expired after 44 years in existence. Any new construction permitted before January will still benefit from the program, but many want to know what the expiration of this program mean for new construction? And how will the projects still under the 421-a umbrella use their […]

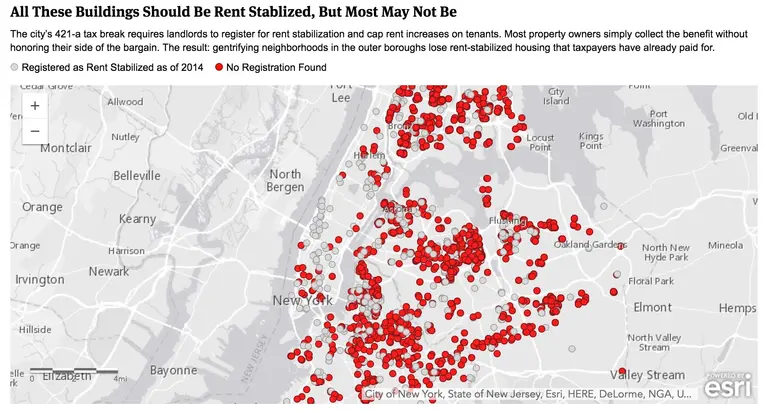

View the map from ProPublica in its interactive form here >>