Everything you need to know about affordable housing: applying, getting in, and staying put

Photo by mari small on Unsplash

Affordable housing has long been a topic at the forefront of NYC politics, but it gained even more attention with Mayor de Blasio’s plan to preserve or build 300,000 affordable units by 2026, which has resulted in a slew of new lotteries, a new more user-friendly web portal, and an update to ease the process for immigrants and low-income New Yorkers. But the topic is not without its issues, especially with the city reeling in the wake of the pandemic. Many still wonder if the city is doing enough for affordability and if some of the available units are really affordable. Ahead, we break down the different types of affordable housing programs, how you can qualify and apply, and what happens if and when you get in.

What are the different types of affordable housing?

In general, New York City defines affordable housing as that which costs roughly one-third or less of a household’s income and is regulated in such a way that the rent cannot increase drastically over time. There are a few different types of affordable housing, though.

New York City Housing Authority

NYCHA is the largest public housing authority in North America. NYCHA developments are built with federal, state, or city funds and are exempt from certain local laws. On average, a household pays 30 percent of their income to live in a NYCHA development, with the U.S. Department of Housing and Urban Development subsidizing the rest.

The national Section 8 program, which allows tenants to put no more than 40 percent of their income toward rent in privately-owned buildings with the federal program subsidizing the difference, falls under NYCHA as well. It can also be administered by the New York City Department of Housing Preservation and Development (HPD) or New York State Homes and Community Renewal (HCR).

According to NYCHA’s website:

More than 400,000 New Yorkers reside in NYCHA’s 326 public housing developments across the City’s five boroughs. Another 235,000 receive subsidized rental assistance in private homes through the NYCHA-administered Section 8 Leased Housing Program.

NYCHA has come under fire in recent years for alleged mismanagement that has led to serious quality-of-life issues, most notably those involving lead paint and lack of heat. At the beginning of this year, NYCHA chair Gregory Russ estimated that the agency now needs $40 billion in capital to repair its thousands of public housing units, though the Biden administration’s $1.7 trillion infrastructure plan allots $40 billion for all U.S. public housing.

Mitchell-Lama Housing

Just as NYCHA is its own city agency, so is the Department of Housing Preservation and Development (HPD), which oversees dozens of affordable housing programs in the city, including “various new construction and preservation development programs, tax incentive programs, senior and supportive housing, tax-exempt bond deals jointly financed with the New York City Housing Development Corporation, and resiliency initiatives, among others,” according to the agency. For apartment seekers, HPD-financed housing is funneled through two lottery systems–Mitchell-Lama Housing and NYC Housing Connect.

The Mitchell-Lama Housing program was created in 1955 to provide affordable rental and cooperative housing to moderate- and middle-income families. These buildings are privately owned but are under a statute with New York state to keep prices affordable. The rents are determined by HPD based on a given housing company’s budgetary needs. Owners receive tax abatements and low-interest mortgages.

When the program was first formed, the developments could not buy out or leave for 20 years. Now, if a given building was built before 1974, it will likely then become rent-stabilized, but if it was built after that year, the building may go market rate. Between 1990 and 2005, 22,688 units, equivalent to 34 percent, of Mitchell-Lama housing was lost. However, in 2017, the city committed $250 million to protect 15,000 Mitchell-Lama apartments from going market rate.

For the cooperative buildings, residents own their units under “limited equity,” which inhibits the profit they can earn from selling their home. To opt out of the program after a restriction period, three separate affirmative votes by the shareholders are required, two of which require a 2/3 vote in favor of opting out. According to HPD, many rental and co-ops “have agreed to remain in the program for up to an additional 35 years in return for government-subsidized loans to pay for the rehabilitation of the aging building systems.”

Just last year, the board of the Bronx’s Co-Op City (with more than 15,300 apartments across 72 buildings it is the world’s largest housing cooperative) reached a deal with HPD that guarantees the development’s participation in the Mitchell-Lama program until 2052.

Affordable Housing

HPD’s second affordable housing program operates through an online portal called NYC Housing Connect (more on that to come) and includes newer units that were constructed as part of market-rate developments through either the 80/20 tax exemption or inclusionary zoning. Simply put, the 80/20 program provides tax-exempt financing to rental developers who reserve at least 20 percent of units for affordable housing. Inclusionary zoning “promotes economic integration in areas of the City undergoing substantial new residential development by offering an optional floor area bonus in exchange for the creation or preservation of affordable housing, on-site or off-site, principally for low-income households,” according to the Department of City Planning.

In certain designated areas, such as the Special Hudson Yards District and the Greenpoint-Williamsburg waterfront, a set number of units may be set aside for middle-income households if the total number of affordable homes is greater. For a recent analysis of middle-income housing, HPD’s Juliet Pierre-Antoine told 6sqft that “the rents for middle-income apartments cross-subsidize the deeply affordable apartments in mixed-income buildings. This helps to bring more operating revenue into the building that maintains it over time without requiring as much City subsidy.” For example, it’s possible for a single person earning $120,000 annually to qualify for a middle-income “affordable” apartment.

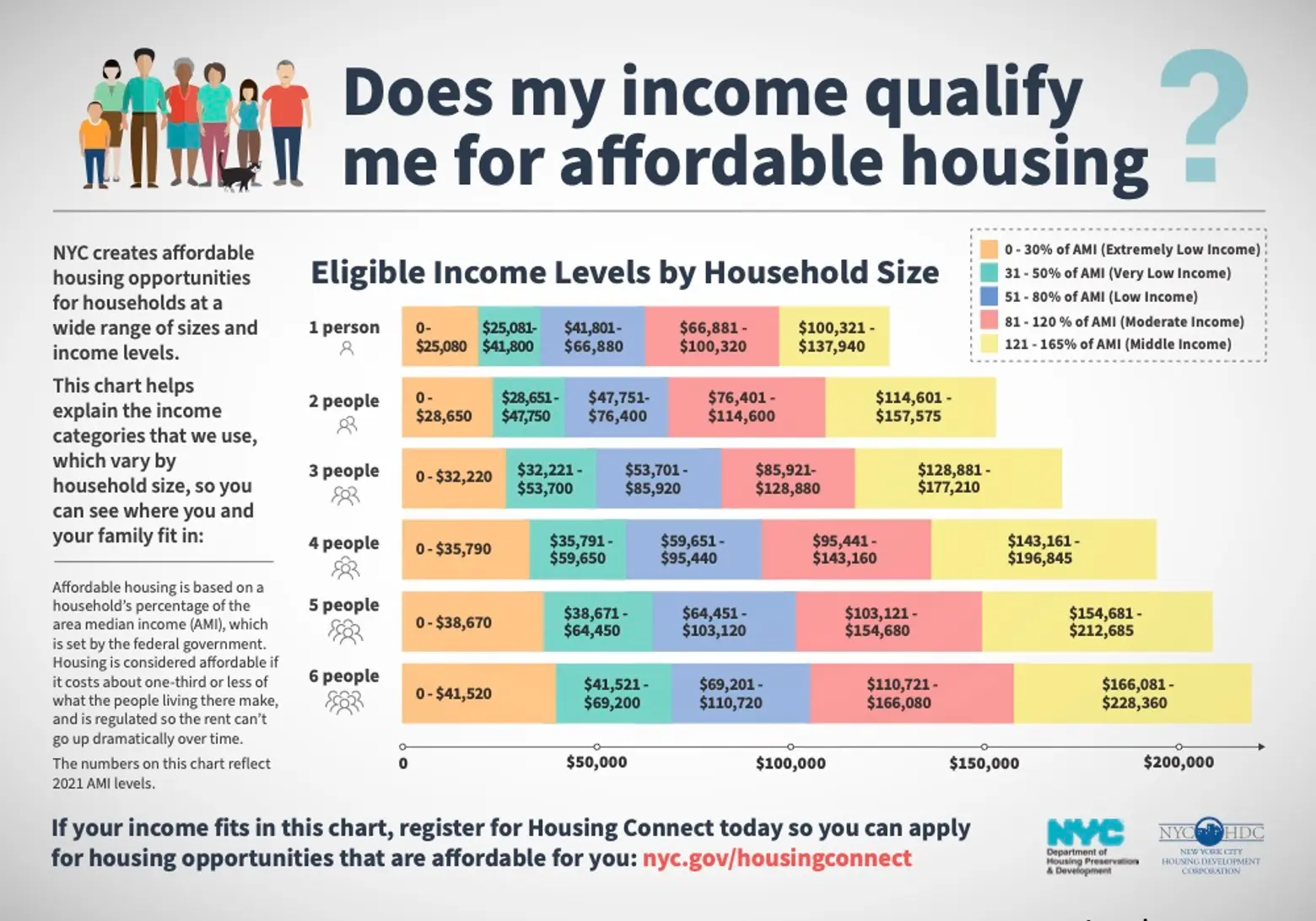

To determine who qualifies for a given affordable housing project, the city relies on Area Median Income. It’s defined each year by U.S. Department of Housing and Urban Development (HUD) (not the city of New York as most assume) using data from the American Community Survey. The 2021 AMI for the New York City region is $107,400 for a three-person family (100% AMI).

As 6sqft previously explained:

New York City’s AMI actually includes several affluent suburbs, including Westchester, Rockland, and Putnam counties. Given that all three suburbs are generally assumed to have higher area median incomes than New York’s five boroughs, many people also assume their inclusion artificially inflates the AMI in New York City.

The city breaks down affordable housing opportunities into five categories:

Extremely Low-Income: 0-30% of AMI

Very Low-Income 31-50% of AMI

Low-Income 51-80% of AMI

Moderate-Income 81-120% of AMI

Middle-Income 120-165% of AMI

Do I qualify and how do I apply for an apartment?

There’s no one formula to find out if you qualify for affordable housing. NYCHA’s eligibility requirements are pretty straightforward, with a simple income limit set for each family size.

The current Mitchell-Lama income limits, courtesy of NYC HPD

The current Mitchell-Lama income limits, courtesy of NYC HPD

Mitchell-Lama is more confusing since each development requires a separate application. There are also three different types of developments, each of which has its own eligibility guidelines–federally assisted rentals, federally assisted cooperatives, and non-federally assisted units. Mitchell-Lama opportunities can only be entered via waiting lists. Thankfully, the online Mitchell-Lama Connect portal allows you to see all waitlists that are currently accepting entries, as well as those that will be opening their waitlists. The portal allows you to create a profile and submit to multiple developments.

From there, you can open two PDFs that show the current Mitchell-Lama buildings with open waitlists and short waitlists that operate on a lottery system. Preference is given to veterans. The lists note whether the building is rental or cooperative and federally subsidized or not. It also shows what type of units are available–studios and one- to four-bedrooms. You can also view featured re-rentals on the HPD website.

Currently, there are 31 buildings across the five boroughs with open waitlists (18 cooperatives and 13 rentals) and three with short waitlists (one cooperative and two rentals). Do note that people who apply to a general open waitlist may not hear back for up to four years. Mitchell-Lama recently introduced its External Waiting List Status through Mitchell-Lama Connect that allows applicants to see the current waiting list number and the date of the last approved application for each development so that they can better monitor their progress.

A portion of the Housing List available after one creates an NYC Housing Connect account

A portion of the Housing List available after one creates an NYC Housing Connect account

For non-Mitchell-Lama affordable housing, HPD has a centralized portal called NYC Housing Connect, which allows users to create a profile, upload required documents, and search housing lotteries that are currently accepting applications by borough, household size, income, and monthly rent.

After the deadline, applications are selected for review through a lottery process. If your application is selected and you appear to qualify, you will be invited to attend an interview to continue the process of determining your eligibility. Interviews are usually scheduled from two to 10 months after the application deadline. You will be asked to bring documents that verify your household size, the identity of members of your household, your household income, and any assets you may have.

The most recent (2021) AMI figures. Source: NYC HPD

The most recent (2021) AMI figures. Source: NYC HPD

As explained earlier in this article, the income requirements are calculated by the Area Median Income (AMI). In addition to falling within a certain range of this figure, applicants must also show 12 months of positive rental history. Until recently, a credit check was required, but the city changed the policy so that New Yorkers without a social security or tax ID number have an equal opportunity to apply.

Depending on where you fall within the AMI chart, you will have an asset limit. For example, an applicant at the 30 percent AMI has a household asset limit of $34,110, while someone at 175 percent has an asset limit of $198,975.

What are my chances?

In May of 2016, the odds of snagging an affordable apartment were about 1,000 to 1. As 6sqft reported, from January to May of that year, 2.54 million applicants applied via Housing Connect for 2,628 affordable apartments. In 2018 (the most recent figures), the odds improved to 1 in 592, despite the fact that the total number of applicants nearly doubled from two years prior to more than 4.6 million. The reason for the increased odds is that they were applying for a whopping 7,857 apartments.

However, a June 2020 article in The City found that “The lower the rent — and the lower the income of the household applying — the more people applied per apartment.” They analyzed more than 18 million applications to the NYC Housing Connect system between January 2014 and March 2019, and found that extremely low-income units saw an average of 650 applications per unit, while on the other end of the spectrum, middle-income units saw an average of 123 applications per unit.

Additionally, you may fall into a preference category. As mentioned, veterans go to the top of the list for Mitchell-Lama housing. And most newly constructed buildings reserve 50 percent of units for applicants within their community district. There are also units reserved for prioritized groups such as municipal workers, seniors, formerly homeless individuals, and those eligible for supportive housing.

If you feel that you’ve been wrongly rejected from a development, you must first contact the managing agent from whom the rejection letter came to file an appeal, typically within 14 days.

Can I keep my affordable apartment forever?

We already touched on this regarding the 20-year Mitchell-Lama contracts, but what about within those two decades? According to the New York State Division of Housing and Community Renewal:

All tenants/shareholders in DHCR supervised Mitchell-Lama developments are required to report their income, and the income of all household members, annually and to comply with housing company requests for documentation. Tenants in federally-assisted developments are subject to HUD’s annual income re-certification requirements. Tenants in non-federally-assisted developments are subject to DHCR’s annual income review procedure.

When it comes to those apartments obtained through the housing lottery, it’s a bit more touch and go. According to the New York City Housing Development Corporation:

Low-income HDC-financed apartments are entered into the rent stabilization system, which would usually mean that your rent will increase by a percentage every year, based on the increase allowed by the Rent Guidelines Board. However, these increases are limited by restrictions on rent increases in the low-income housing programs. Middle-income apartments are entered into the rent stabilization system, which means that your rent will increase by a small percentage every year, based on the increase allocated by the Rent Guidelines Board.

Contrary to what most people believe, HDC notes that if a tenant’s income goes up or down it does not affect the rent. The same is true for NYCHA and Section 8.

However, if an affordable unit was financed through a city tax abatement program such as 421-a or the Low Income Housing Tax Credit (both part of the 80/20 program), you should be aware of when that abatement expires, because at that time the rent stabilization will no longer be in place and you may not be entitled to renew your lease. All of this information should be made available at the first lease signing.

+++

Editor’s Notes: This story was originally published in 2015 and has been updated. All data, income figures, and policy information reflects those most current at the time of republishing.

RELATED:

Get Insider Updates with Our Newsletter!

Leave a reply

Your email address will not be published.

I applied almost five years ago to several Mitchell-Llama properties, and my husband is a veteran, and I’m just getting calls now. But unfortunately, now we longer qualify.

Indeed – for how long will these so called affordable units be affordable? And, what is the mechanism to make sure these apts will be affordable forever? If we are to leave it to REBNY to oversee this, or individual developers, then this is a chimera. It will be what we all suspect: A political sound bite for a politician who sees himself in the White House in a few short years. LOL.

I wish I had known about this program when I first moved to NY and spent years struggling to make rent. The city needs to better promote programs like these. You don’t really begin to understand the system and what’s available until you’re years in and have gone down 1,000 different paths to finally get to what’s just a relatively comfortable position.

My husband is a veteran and we have not been put on any priory list. That’s balonga. I’ve been applying for over a year and because we o recently live in Colorado we are on the end of the stick which is discrimination. They said veterans will get first prioty, it doesn’t matter if we live in Antarctica. He has a permanent lung disease from exposure to polyurethane paint and we have to relocate to low altitude so he can breathe. I was born and raised in New York City and Long Island.

What happens if you are elderly and disabled and live in an 80/20 affordable housing unit when the set 20-year lease expires and the 421-a tax-benefit lapses? Do this mean you suddenly become homeless if you can’t afford to pay market rent for the same apartment? The laws need to be changed.

That’s what I call the useful article! 🙂 What do you think of top property management companies new york?

what does lottery pending means?

what happens if you you win the lease in two lotteries?

The First one is approved …. you sign the lease.

Then you get approved for the second one and it is better for you because it is closer to work and family; overall a better fit. Can you choose to break the first lease and move into the 2nd one?

Fishy. Didn’t think so at first, but I began applying through snail mail.. or tried to. I’ve only received two applications to fill out. One I sent out, the other was never even sealed by the office people it seems. I received it wide open. The rest of the applications I asked for are not here and the deadlines are going to pass. Seems this is how they are getting who they want in also. If they mail it to you two days before, of course your application will be late. Have people gotten in? I’m sure. But corruption is everywhere.

The mayor needs to revise this. There are too many rules to get in and too many unanswered questions i.e. pending, tenant selection in progress????? Then you have a short window to respond or you miss the interview. Suppose someone is homeless, how do they get a chance when these lotteries require everything short of a DNA sample to get in. They want perfect tenants in an imperfect world, and a lot of this stuff seems unconstitutional. Why are applicants being asked to show copies of leases of people who they are temporarily living with? This system has become ridiculous. There was an article that said that most of these units are being rented to young professionals. Who is monitoring the selection process? Are people of color, the elderly or the disabled being chosen for all neighborhoods or are they being moved further out? Here’s a solution – Just build more buildings so that people can have a cleaner and more affordable place to live. Put the slum landlords out of business, clean up the ghettoes that the racists created, lower these massive rents, and give the working class citizens a chance to live a decent life for themselves and their families. We were on our way until “greed” took over and laws were passed to price people out of neighborhoods they were living in for years. Add landlords who harrassed people until they left so that they could raise their rent plus a slow court system and here we are. I wish that phony leaders would find another job. This is what the people in New York should be marching for, but people always think things are other people’s problems until one day they wake up and it ends up in their backyard.

“Another important fact to note: “a lot of affordable rent seekers think they’ll end up in the less desirable units—when in truth, affordable housing units are required to be evenly distributed throughout the entire building.”” I live in one. The subsidized units are not as nice nr are they maintained. And we are all getting our rent raised to market as we near the end of the deal.