Why middle-income New Yorkers are turning down affordable housing

Photo via CityRealty

It sounds like a dream come true. After a decade of living and struggling to pay your rent as a middle-income New Yorker, you get an email from NYC Housing Connect that says, “Invitation for Interview” followed by the address of the building to which you applied. For a moment, you are ready to break out the champagne and start celebrating the fact that that rent-stabilized, affordable NYC apartment you have always dreamt about living in—yes, that massive apartment that is only a fraction of everyone else’s monthly rent—is finally in reach. But then, like a lot of middle-class New Yorkers, you start to seriously consider whether you’re ready, willing, and able to accept what NYC Housing Connect is actually offering.

Photo via Roman Kruglov/Flickr

Photo via Roman Kruglov/Flickr

Middle-Income New Yorkers and the Housing Plan

Notably, most of the housing creation and preservation that has been financed under Mayor de Blasio has targeted extremely low, very low, and low-income households, which means households earning no more than $68,730 annually. However, as part of the plan, the city has also created a small number of homes for middle-income New Yorkers.

When contacted to respond to this article, Juliet Pierre-Antoine from the NYC Department of Housing Preservation & Development told 6sqft that of the 87,500 affordable homes financed so far, the city has created 10,760 affordable homes for middle-income households. While diversifying housing communities is part of city’s mandate, it is not the only reason the city has created a small number of units for middle-income families. “These apartments are important not only because they give middle-income families an opportunity to live in a new, rent-stabilized, privately owned affordable apartment,” explains Pierre-Antoine, “But also because the rents for middle-income apartments cross-subsidize the deeply affordable apartments in mixed-income buildings. This helps to bring more operating revenue into the building that maintains it over time without requiring as much City subsidy.”

Middle-Income Families Often Pay More for Affordable Housing

While a growing number of middle-income New Yorkers are eligible for affordable housing units (middle-income families of six can make up to $182,000 annually and still qualify), moving into one of the City’s new “affordable” units may or may not cost less than one’s current market rent. But the likelihood of paying just as much or more than one’s current rent is not the only thing causing middle-income New Yorkers to turn down the opportunity to snatch up one of Mayor de Blasio’s affordable housing units for middle-income families.

Catherine is a university professor who lives with her partner, Chris, a writer and part-time teacher. They have two children. Catherine and Chris currently live in a small converted one-bedroom on the Upper East Side, and while it is far from perfect, at $2,900 a month, they consider their small apartment in a full-service building to be a “pretty good deal.” Nevertheless, as their children grow, they would love to move into a flex-three or proper three-bedroom, and as a result, they have started to apply for the few city housing lotteries for which they qualify. To date, despite being called for interviews on two occasions (first for a unit at Stuy Town and then for one at 38 Sixth Avenue in Brooklyn), Catherine and Chris have turned down both interviews.

“I hate to admit it, but yes, twice we’ve decided we can’t do this,” says Catherine. “First, we applied for a unit in Stuy Town, but we’ve heard a lot of nasty things about the buildings and community and it just didn’t seem very appealing. We were also about to leave for vacation and worried we wouldn’t have enough time to get our paperwork together. Then, we got an interview 38 Sixth Avenue. Depending on Chris’s freelance income each year, we make between $140,000 and $160,000, which means we’re 165% of the AMI. We wondered, why pay $800 more than we do now to live further from work, and could we even afford such a rent hike? Depending on the month, this would mean spending over 50% of our take-home pay on housing, which is a bit scary.” But this wasn’t the only reason why Catherine and Chris ultimately turned down both of their interviews when contacted by Housing Connect.

Photo via Pexels

Photo via Pexels

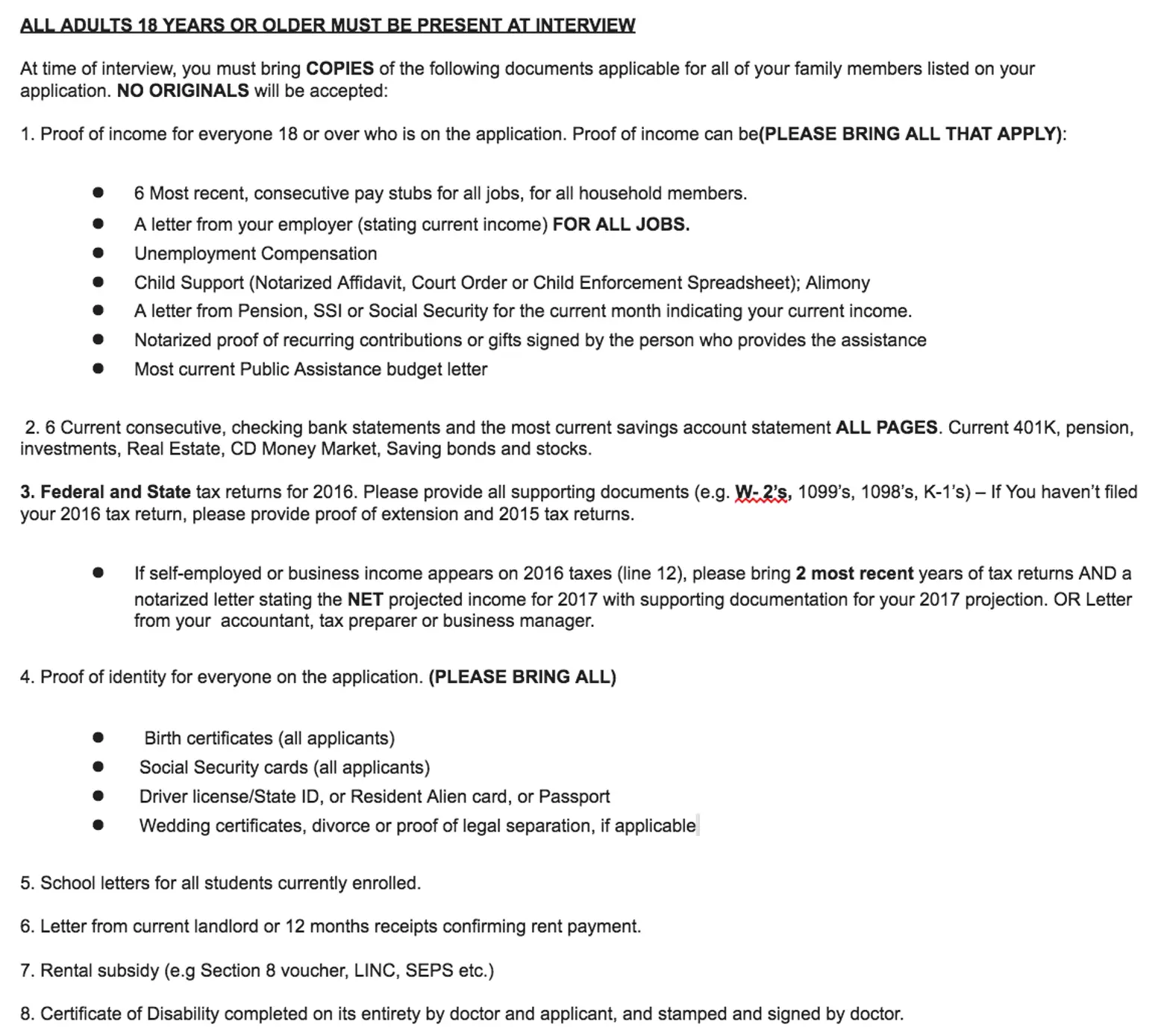

Excessive Paperwork and Heightened Surveillance

“I was also really blocked about the paperwork,” admitted Catherine. “I understand, they want pay stubs, recent tax returns, that’s normal, but some other parts of the process made me feel like a criminal. Does the city really need a letter proving our kids are enrolled full-time in their public school system? Don’t they already know that!” Catherine was quick to add, however, that she doesn’t think she should get special treatment as a middle-income New Yorker. “I say this knowing just how privileged we are. Chris and I can afford to turn down the opportunity. Still, should a mom living on $35,000 a year with two kids who has no choice have to come up with all that paperwork? I mean, I really don’t think that people with money stashed away in secret bank accounts are going to go through the hassle of applying to a Housing Connect lottery, but that seems to be the implication!”

Not surprisingly, the NYC Department of Housing Preservation & Development has a different perspective on this issue: “While we can appreciate the application process is extensive, we have established marketing guidelines and rules to ensure that each housing opportunity is given to a qualified applicant while meeting Fair Housing standards.”

Paperwork that one must bring to their Housing Connect interview in order to qualify for an affordable unit.

Paperwork that one must bring to their Housing Connect interview in order to qualify for an affordable unit.

While paperwork is an obstacle for some potential renters, it is not the only concern. Kendra and Pierre have one child and both work as language teachers. They currently qualify for units in the 130% AMI bracket. Despite their desire to move into a rent-stabilized unit, which seems like a good long-term decision, they have also turned down an interview opportunity. “We love to travel, and I’m a dual American-French citizen, so we actually spend a lot of time in France,” says Pierre. “But we realized that we would no longer be able to sublet if we moved into an affordable unit with the city. Our current landlord is okay if we approve the tenant first, so this would be a huge sacrifice for us. I understand why they need rules, but it’s not compatible with our lifestyle.”

Upkeep and Access to Building Amenities

In addition to concerns about potentially higher rents, excessive paperwork, and inability to sublet, both of the couples interviewed for this article expressed doubts that the buildings for which they had been selected would, in fact, be kept up over time. As Catherine said, “Maybe this is a false assumption, but given the current state of lower-income housing in New York, why should I trust that the city will maintain its 100% affordable rental buildings over time?”

While both couples agreed that moving into a building where only some of the units are rent-stabilized would likely offer a higher assurance that the building would be maintained over time, on this account, they expressed other concerns. Kendra wondered why so many of the full-service buildings in the Housing Connect lotteries offer rent-stabilized units without access to any of the building’s services. “In some of the lotteries that we qualify for, we’d be paying higher rent than we do now and additional fees for all the amenities. I don’t know if we can afford extra for access to a gym or bike storage and of course, these fees would go up over time because they aren’t part of the rent-stabilized deal.”

While city officials continue to insist that middle-income New Yorkers simply don’t realize they are eligible to apply for affordable housing units, there are evidently other reasons that middle-income earners are failing to move into the city’s new affordable housing units, even when selected for an interview in a housing lottery.

From the perspective of the NYC Department of Housing Preservation & Development, however, striving for a mix of tenants remains important both on an economic.“Diversity is something that we should be striving for,” says Pierre-Antoine, “And this point is particularly poignant considering this week is the 50th anniversary of the Fair Housing Act, which not only took solid first steps toward the fight to end housing discrimination, but also required all municipalities to affirmatively further fair housing standards.” To help further dismantle discrimination and segregation in housing, the city also recently launched Where We Live NYC, a data-driven collaboration that hopes to uncover some of the historic and current forces that continue serve as an obstacle to the creation of diverse neighborhoods.

RELATED: