Search Results for: 220 central park

Buildings

Articles

Photo of 220 Central Park South in front of 111 West 57th Street (cropped) by Jim Henderson via Wikimedia Commons

$80M penthouse sale at 220 Central Park South is one of year’s biggest deals

Details here

Joe Tsai’s firm revealed as buyer of $190M penthouse at 220 Central Park South

Get the details

220 Central Park South. Photo by Jim.henderson (cropped) via Wikimedia Commons.

Billionaire Daniel Och sells 220 Central Park South penthouse for $190M

Get the details

220 Central Park South as seen in May 2020. Photo by Jim.henderson (cropped) via Wikimedia Commons.

Billionaire Joe Tsai revealed as buyer of $157.5M condos at 220 Central Park South

READ MORE

220 Central Park South as seen in May. Photo by Jim.henderson (cropped) via Wikimedia Commons

220 Central Park South is the best-selling NYC condo by a long shot

READ MORE

Photo of 220 Central Park South in front of 111 West 57th Street (cropped) by Jim Henderson via Wikimedia Commons

$100M penthouse closes at 220 Central Park South, third-most-expensive NYC sale ever

READ MORE

NYC’s third-priciest apartment ever just sold at 220 Central Park South for $92.7M

READ MORE

NYC’s third $100M+ real estate deal closes at 220 Central Park South

More info

Robert A. M. Stern’s 220 Central Park South passes $1B in sales

More info ahead

Photo of 220 CPS via CityRealty; photo of Sting via Wiki Commons

Sting drops $66M on penthouse in millionaire-magnet 220 Central Park South

READ MORE

Photo of Bezos via NMAH’s Flickr; 220 CPS photo via a Vornado Realty Trust and Robert A.M. Stern Architects

Jeff Bezos is reportedly checking out $60M apartments at 220 Central Park South

Get the details

Get a rare look inside 220 Central Park South thanks to this $59K/month rental

Look inside

Daredevil climber scales Robert A.M. Stern’s 220 Central Park South to capture these insane shots

See all the photos right here

Robert A.M. Stern’s 220 Central Park South now two-thirds erected

More photos of the tower under construction here

Sting and Trudie Styler Buying 220 Central Park South Triplex

Find out more

$250M Penthouse at 220 Central Park South Will Officially Be NYC’s Most Expensive Apartment

Check out the insane floorplans

Robert A.M. Stern’s 220 Central Park South Gets Stoned; New Renderings and Construction Shots

Check out the renderings and construction shots right here

220 Central Park South Costs $5,000 Per Foot to Build, Now 50 Percent Sold

READ MORE

Hedge Fund Tycoon May Be the Buyer of $200M Penthouse at 220 Central Park South

More details this way

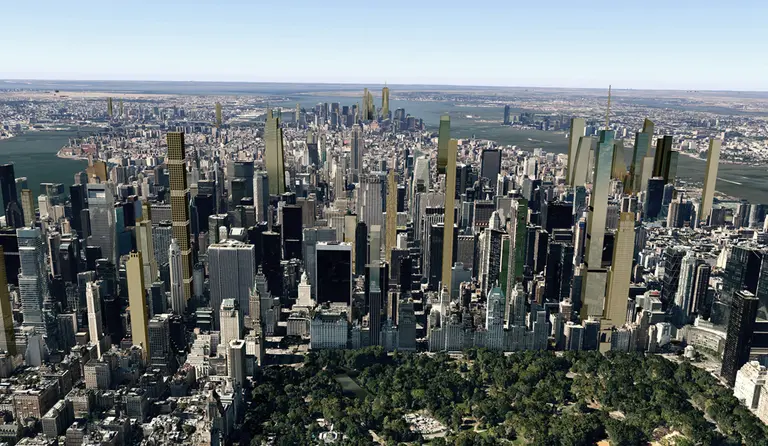

NYC Entering Biggest Building Boom in 50 Years; New Rendering of 220 Central Park South

New residential construction permits are at the highest since 1963, likely attributed to the expiration of the 421-a tax break. [WSJ] Two Billionaires’ Row condos, 111 West 57th Street and 1 Park Lane, only subsidized 23 affordable housing units. [DNAinfo] Jeopardy host Alex Trebek bought a $1.92 million fixer-upper Harlem townhouse for his 25-year-old son. [NYP] […]

Construction Update: Robert A.M. Stern’s 220 Central Park South Begins Race into the Sky

See new images of the tower here

‘Dog Racism’ on the Upper West Side; $250M Penthouse at 220 Central Park South in the Works

An Upper West Side co-op wants to use dog DNA tests as a way to keep unfavorable breeds out of their building. [DNA Info] Developer Michael Shvo said to be eyeing the $120M townhouse trio. [NYP] Inside a mysterious cottage sitting atop an East Village building. [Curbed] Bloomberg is making a $100 million donation to the Cornell […]

One-Third of 220 Central Park South Sold; One Vanderbilt Moves Forward with Full City Support

After just six weeks, one-third ($1.1B) of 220 Central Park West has been sold. “Acceptance by brokers and buyers has been extraordinary and unprecedented.” [TRD] One Vanderbilt is well on its way to becoming a reality. This morning SL Green cleared its final major hurdle, receiving approval, with some amendments, by a key City Council subcommittee. [Crain’s] Philip […]

220 Central Park South Penthouse Could Set a New Record with $175 Million Price Tag

Find out more here, plus floor plans!

$3.4M Park Slope triplex condo has a roof terrace with heavenly views

Tour the triplex