From the ‘Seinfeld Law’ to Doggie Interviews, The Craziest Co-Op Board Stories Around

If you think you’re in like Flynn because you’ve got the dough, you’re still far from done if you’re buying a co-op. Since co-ops account for some 75 percent of New York’s housing stock when it comes to buying, you’d better hold onto your hat. That’s because you still haven’t sat in the personal interview-hot seat with the building’s gatekeepers to not just assess your finances, but to evaluate your worth as an individual. Whether you’re a billionaire, a celebrity, of just a regular Jane with designs on one of these spaces, just keep in mind that there are a set of commandments that are never to be broken. Because when they are, there will be hell to pay.

We’ve gathered up some of the best co-op board horror stories around, with anecdotes that involve everyone from Jerry Seinfeld to Steven Spielberg to a feisty little dachshund caught up in a bait-and-switch.

Without Rhyme or Reason

As if being judged isn’t pain enough, to top that off, a board doesn’t even have to tell you why you’re not getting the green light. This was the case at the celebrity-filled San Remo on Central Park West when the board nixed million-dollar-plus purchases by Madonna in 1985 and Calvin Klein in 1986. The equally star-studded Ardsley up the street turned Mariah Carey away when she tried to purchase fellow songbird Barbra Streisand’s 8,000-square-foot digs back in 1996 (Ironically, Streisand had been turned down by the board at both 740 Fifth Avenue and 1107 Fifth Avenue years before).

Notable by many as the home of some of the most famous people on the planet, once including Lauren Bacall and John Lennon, some might say the Dakota at 1 West 72nd Street is also known for turning down equally famous buyers. Billy Joel, Cher, Antonio Banderas and Melanie Griffith are some of the high profile celebs to have gotten the cold shoulder. Ditto for 19 East 72nd Street. Their board initially approved Richard Nixon several years after the disgraced president left office, but retracted its approval when fellow shareholders rebelled.

No Ifs, Ands or Butts

Even if you’re lucky enough to pass muster, you still better pray that house rules will be the usual common sense dos and don’ts—like keeping music or noise down after a certain hour. Some buildings are known to ask their tenants to fork over big bucks to soundproof a room before moving in to tickle the ivories. Or if things really go sour, you could find yourself on the other side of a lawsuit when your neighbor gets hot under the collar when it comes to, say, your smoking habits.

That’s exactly what happened to Galila Huff, a long-time chain smoker who had been living in the Ansonia for 15 years when a family moved into a unit close to hers. In 2008, Jonathan and Jenny Needleman Selbin (both lawyers) sued her because her cigarette smoke was wafting its way along their common hallway. Infuriated and concerned that secondhand smoke would jeopardize the health of their four-year-old son, the suit demanded that Huff “cease and desist from causing smoke to enter into the common hallway,” and that she pay punitive damages, according to the complaint filed in New York’s Supreme Court. Interesting enough, and a bit off point, they also claimed Huff encouraged her Chihuahua Boo-Boo to urinate outside their front door and on their son’s stroller while it was parked in the hallway.

Though certainly she would have done anything to avoid hurting anyone, let alone her neighbors, Huff lamented to a New York Times reporter back then that she desperately wanted to quit, but just couldn’t—and in fact, she seriously considered selling to avoid the ongoing pressure from the Selbins.

In hopes of alleviating the situation, according to the Times, Huff purchased two Oreck XL air purifiers (double the number the manufacturer would have recommended for her 635-square-foot apartment) and kept windows open as much as she could. She even sealed the bottom of every door with rolled-up rugs. Not surprisingly, the Selbins apparently demanded to see receipts to prove their existence but Huff refused. The Selbins eventually dropped the suit because Huff agreed to use a top-notch air filtration system, a window fan and a smokeless ashtray in her home.

The “Seinfeld Law”

Then there is the so-called “Seinfeld Law,” supposedly the result of comedian and Emmy Award-winning TV star Jerry Seinfeld’s move to the Beresford on Central Park West. It was reported that he took way too long (several years) to renovate his newly purchased apartment in 1999. And this was right after Apple genius Steve Jobs contracted a jack-hammer-filled re-do that took upwards of seven years. Oscar-winning film director Steven Spielberg also committed a similar sin when his crew took 18 months inside the San Remo, also on Central Park West.

As a result of Jobs, Spielberg and Seinfeld’s elongated renovations, dozens of Manhattan co-ops enacted a new house rule to avoid similar situations: For every day that a renovation continues after its scheduled completion date (about 90 days) the owner must pay the co-op fines generally ranging from $250 to $500 a day. If the work exceeds 150 days, fines sharply rise to as much as $2,000 a day. Some buildings now require flow charts, which are monitored by a building’s architectural overseer every two weeks.

A board can also enforce “summertime” only renovations (between Memorial Day and Labor Day) because the assumption is that most of a building’s residents will head for their summer retreats during this time. In other words, if you close in October and want to make changes before moving in, you’ll have to wait until the end of the following May to get cracking. However, it can get worse. Back in 2000, the New York Times reported that a co-op board for a building near Union Square had zero problems when it came to approving a couple’s plan to combine their old apartment with the one they then bought on the floor below. There was only one caveat: they couldn’t use power tools.

Image via Wallcoo

Image via Wallcoo

Doggie Deal Breakers

According to some brokers, house rules regarding pets can include the right to evict the family pet if there have been two or more “behavioral” complaints (read: barking and/or biting issues) from neighbors, submission of a dog’s certification from an obedience school with their application to purchase, and/or the pet’s weight or breed (if your pooch is a Great Dane or an Irish wolfhound, you’re probably out of luck). Bottom line? More than a few co-op boards require doggie interviews. And during that interview, a board member might very well ring a bell or knock on a door in order to test the dog’s barking proclivity.

A while back, a broker represented a buyer who owned a barking and often feisty dachshund who would, unquestionably, blow the deal. Both the broker and hopeful buyer knew that there was no obedience school in existence that could get this dog interview-ready. Unbeknownst to the broker, the potential buyer had a sister who owned their dachshund’s sweeter, more docile sibling, and they simply switched the dogs on the day of the interview to ensure a seal of approval. They only clued in the broker a year later.

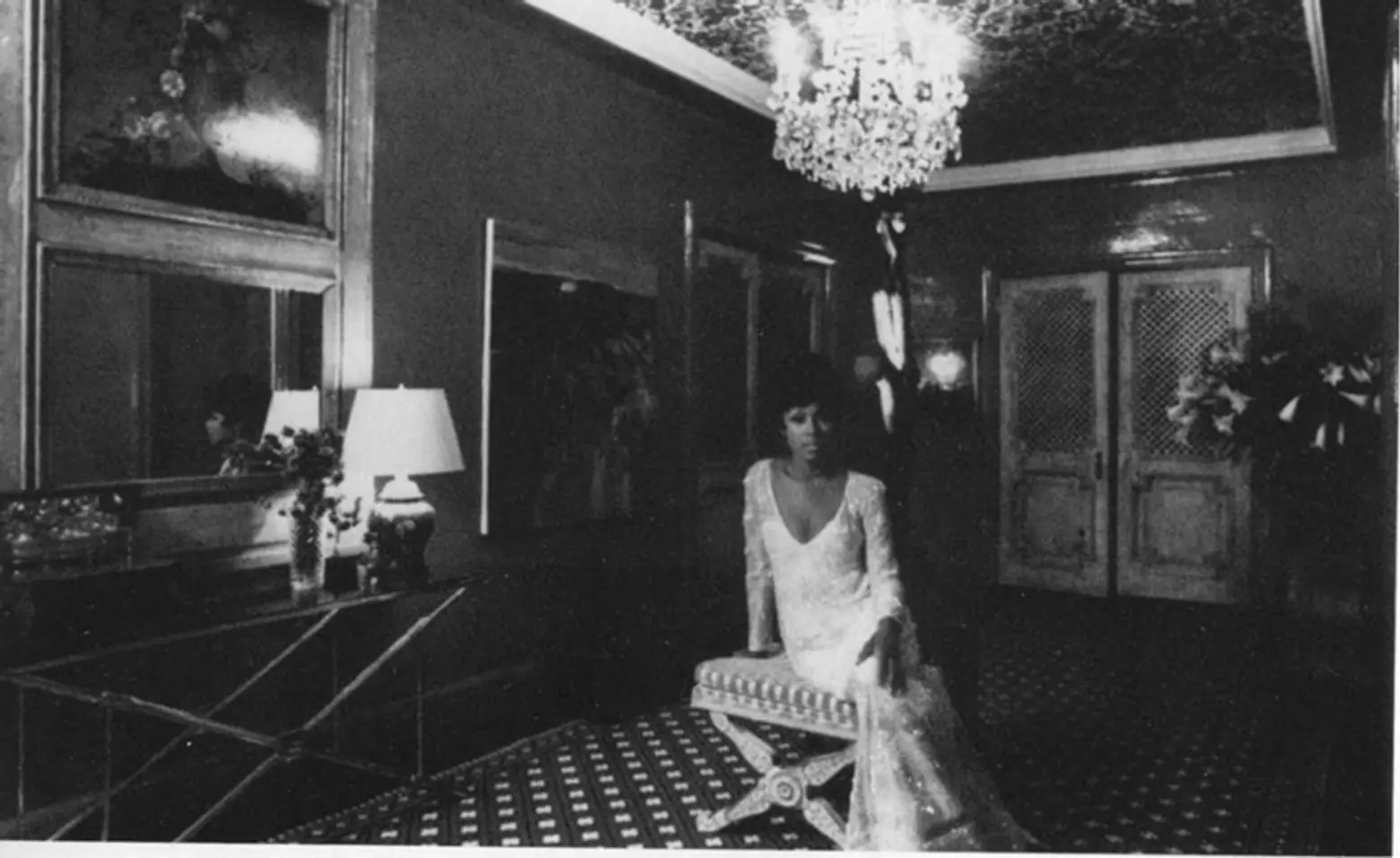

An old image of Diahann Carroll in her flat via TCF

An old image of Diahann Carroll in her flat via TCF

Killer Conversions

When Tony and Emmy Award-winning actress/singer Diahann Carroll attempted to sell her sprawling co-op on Riverside Drive at 89th Street in 1993 for about $1.5 million, she hit a snag. In 1965, Carroll had rented the 11th floor, nine-room apartment with sweeping Hudson River views for just $500 a month from Lawrence Eno, the rent-controlled tenant of record. Eno eventually handed over the rights to the unit to Carroll, but under one condition: If the building ever went co-op and she purchased it, Eno had the right to buy it back at the original purchase price when she was ready to sell and move.

The building indeed converted to a co-op three years later (with Eno said to be on the board) and Carroll paid an insider price of $25,175. Though Carroll fought the contractual written obligation in order to get well more than a million dollar profit decades later, a unanimous court decision in 1996 found nothing unreasonable about the deal and forced her to honor the 31-year-old agreement to sell her million-dollar co-op for a paltry $25,175 to the 81-year-old retired attorney Eno. Thus, Carroll decided to stay put and didn’t move.

RELATED: