New Map Reveals Which Luxury Skyscrapers Are Siphoning Your Tax Dollars

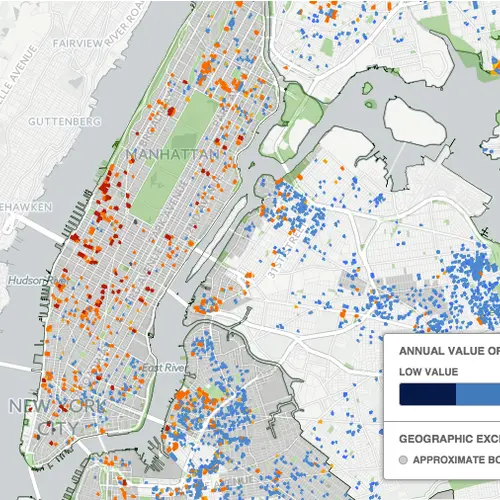

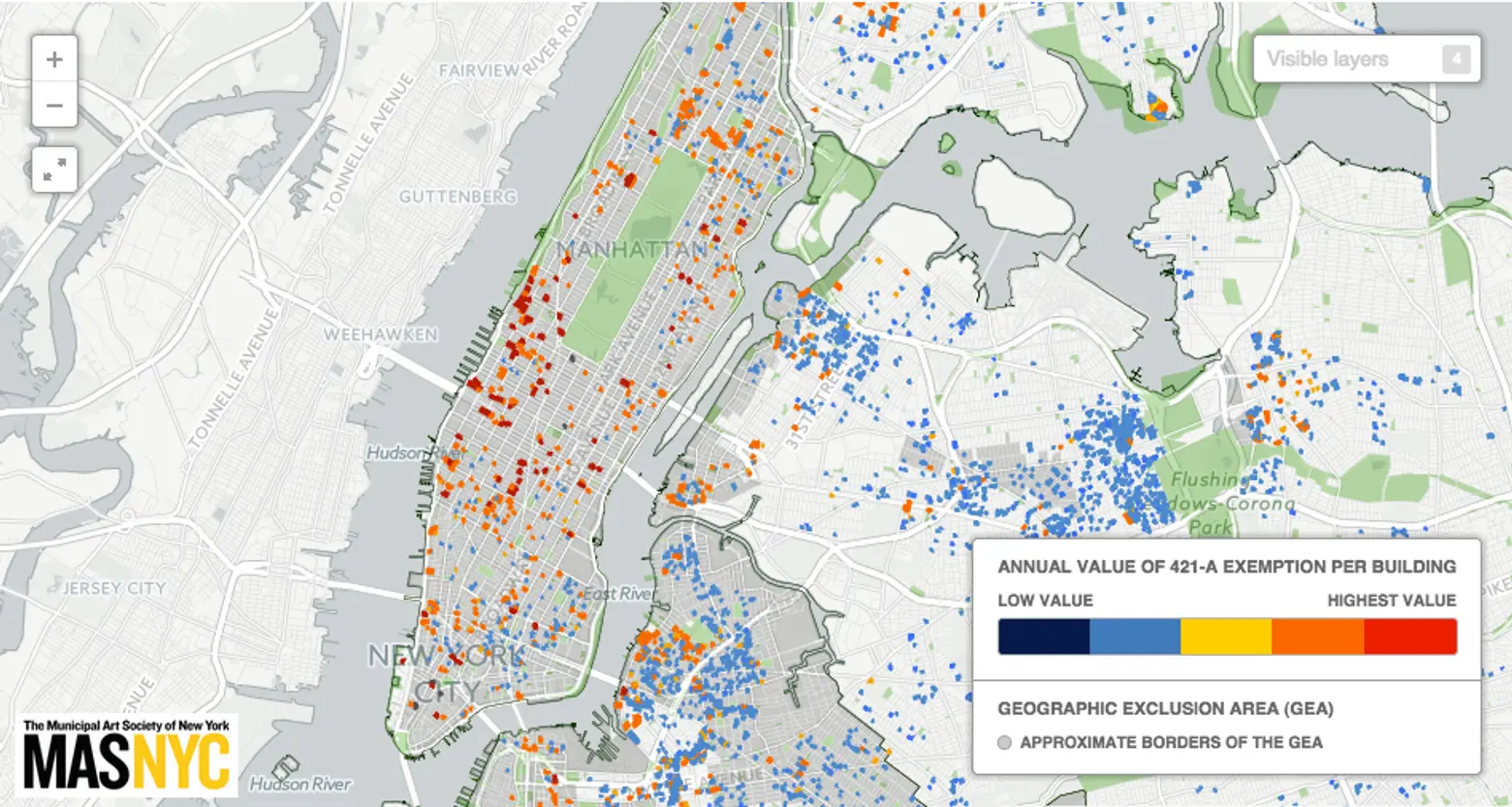

By now it’s no secret that there’s an unbalanced tax system in place for those living in the city’s luxury towers, but exactly how much is being lost–and where–has for the most part been a mystery. To shed some light on just how much of our money goes into subsidizing the likes of One57 and its eye-poppingly expensive friends, the Municipal Arts Society (MAS) has created a map (h/t Gothamist) that shows not only how much tax each of the city’s top buildings skip out on annually under the 421a tax abatement, but how long their exemption will last—which together can add up to staggering amounts for many. Last year alone, MAS found that we forfeited $1.1 billion in tax revenue and 60 percent of that went to building apartments in Manhattan targeted at the 1 percent.

To create the map, MAS used data from the Department of Finance, the Department of Housing Preservation and Development, and the Department of City Planning. Prior to the map, no government agency had been tracking the affordable housing output of 421-a. “It’s not the 1970s anymore. In these booming Manhattan neighborhoods, the only value of a 421-a program is to spur affordable housing, yet the data on 421-a’s affordable housing impact is largely unavailable. And what information we do have is scattered across three city agencies,” said Margaret Newman, Executive Director of MAS in a press release.

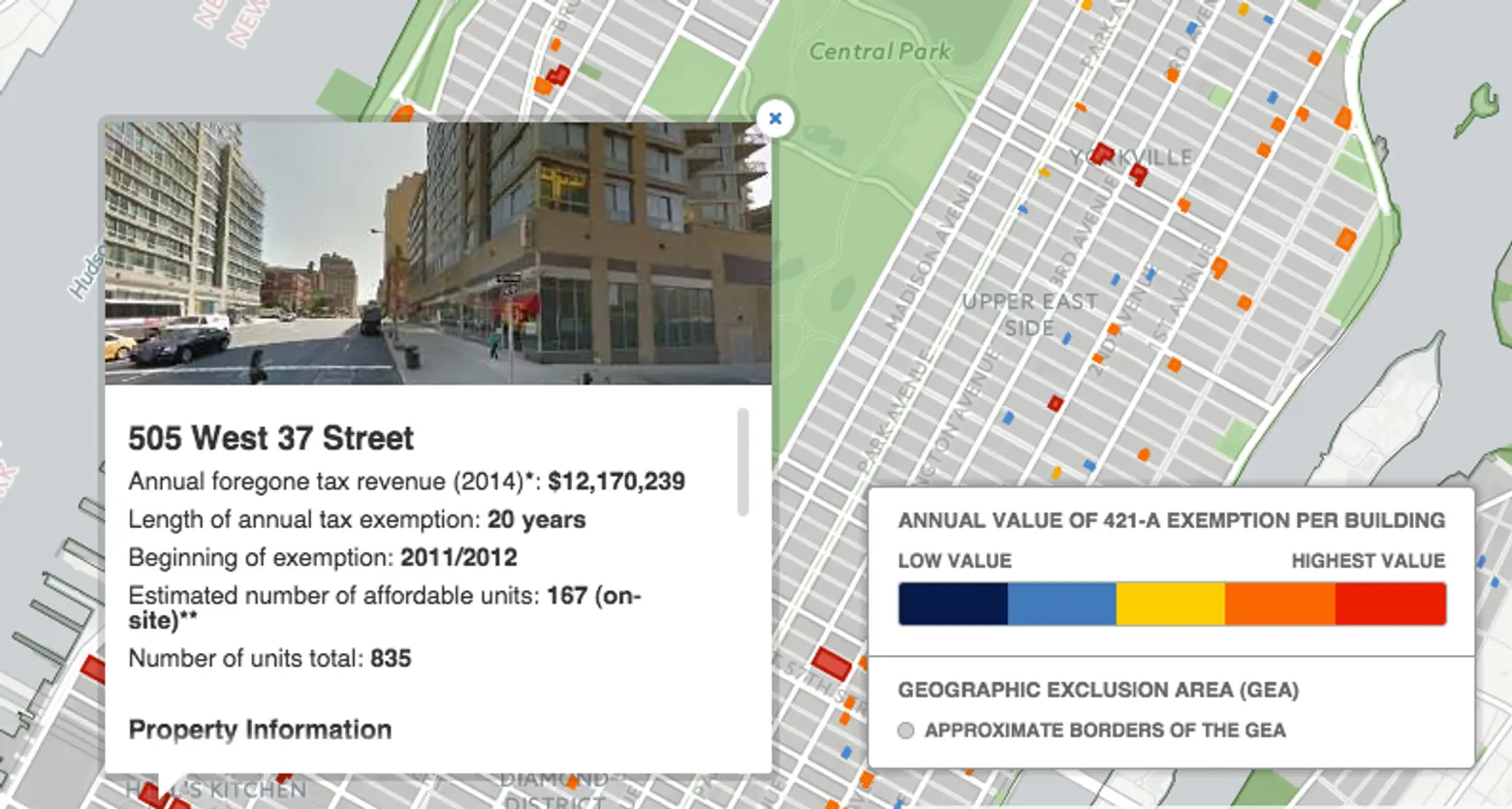

MAS also highlighted some figures for the following addresses:

- 535 West End Avenue: City forfeited $3.3 million in tax revenue in 2014 subsidizing 6 affordable units built in 2013; this annual exemption continues through 2023

- 150 East 86 Street: City forfeited $5.8 million in tax revenue in 2014 subsidizing 24 affordable units built in 2011; this annual exemption continues through 2021

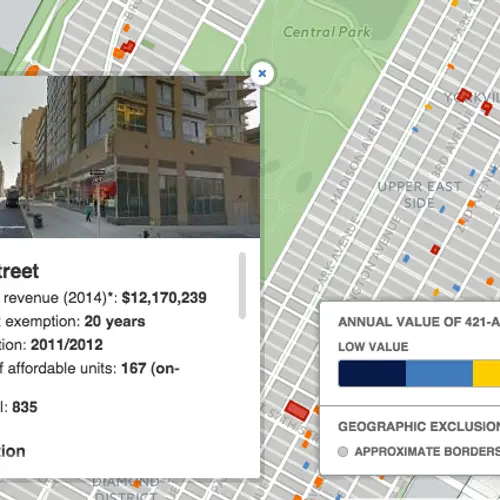

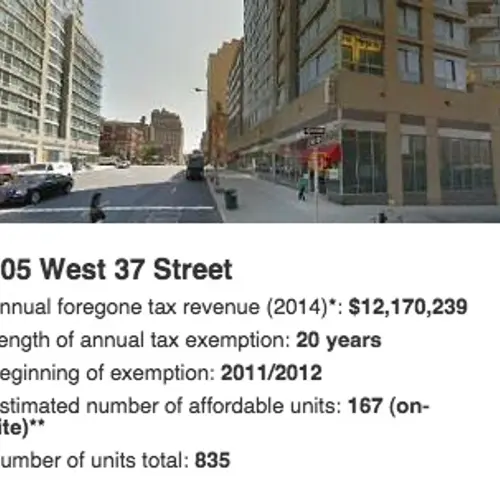

- 505 West 37 Street: City forfeited $12.1 million in tax revenue in 2014 subsidizing 167 affordable units built in 2012; this annual exemption continues through 2032

MAS’s argument is that the current 421-a program in place needs to be completely revamped to address this disparity. This namely means strengthening the affordability requirements or decreasing the financial incentives, increasing the program’s public transparency and using this data to monitor the program’s successes and failures, and, above all, redrawing the lines of the GEA to reflect actual market conditions. “The geographic exclusionary area should do just that—exclude luxury neighborhoods from cashing in on 421-a,” says Newman.

The 421-a program is up for renewal in June.

[Via Gothamist]

RELATED: