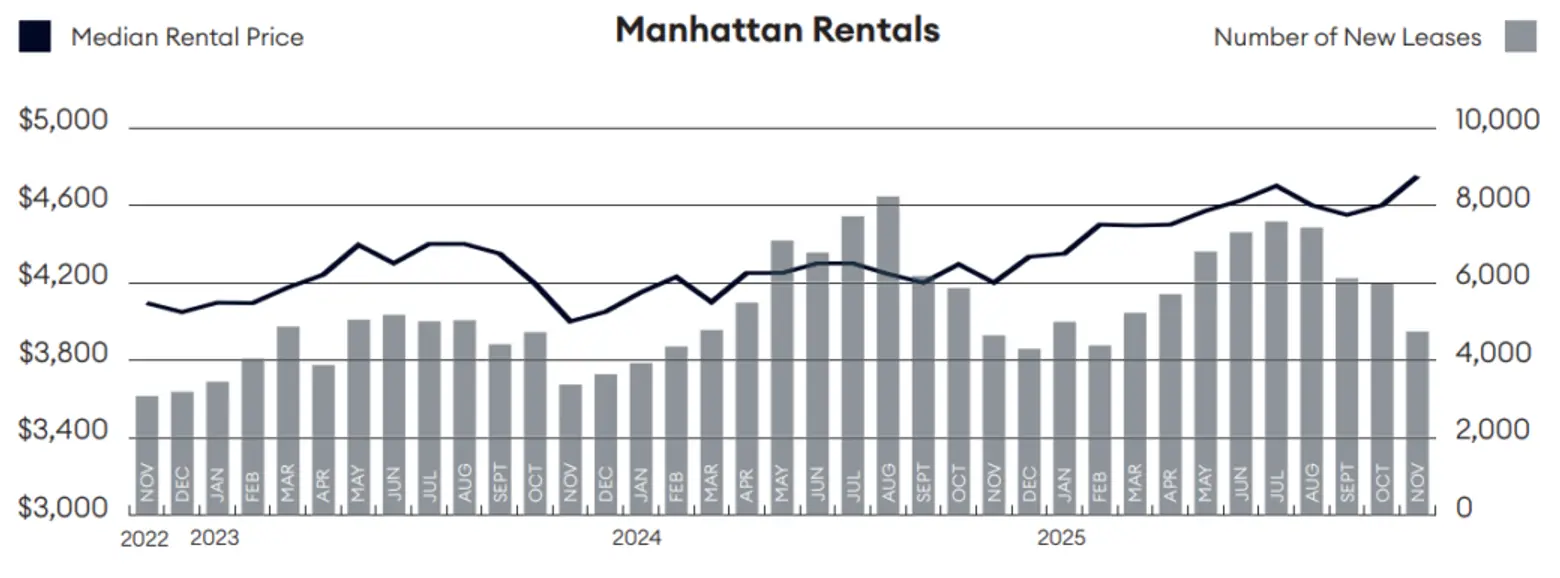

Manhattan median rent prices set new highs in November, reaching nearly $4,800/month

Manhattan rents hit new highs again in November, with the median price almost reaching $4,800, a 13 percent year-over-year jump, according to a new report released this week. Prepared by appraisal firm Miller Samuel for Douglas Elliman, the November 2025 Elliman Report shows the median rent price rose more than 3 percent from $4,600 in October. The borough’s average rent climbed to a record $5,686, up nearly 1 percent from last month and almost 13 percent annually, while the average price per square foot reached a new high of $95 after rising 5.6 percent since October and 10.1 percent from last November.

Median rents grew at their fastest pace in nearly three years, nearly doubling the 8 percent annual increases seen earlier in 2025.

In Manhattan, the upper half of the housing market—measured by doorman apartments—comprised 54.7 percent of all new lease signings. Their new lease signings rose 11.4 percent yearly, while non-doorman apartments fell by 7.3 percent over the same period.

On the east side, median rent rose 15.2 percent year-over-year to $4,075, while new lease signings increased 6 percent. On the west side, median rent grew 7 percent annually, even as new lease signings fell 4.4 percent. Vacancy rates increased annually.

In downtown Manhattan, median rents rose 14.8 percent yearly to $4,575, while new lease signings increased 4.4 percent. The vacancy rate remained relatively stable. Uptown, median rents climbed 7 percent to $2,890, even as new lease activity declined 1 percent. Vacancy rates fell over the same period.

Luxury rentals in the borough, which make up the top 10 percent of listings, started at $8,700 in November, a 10.1 percent annual increase. This sector’s divergence from the broader market is evident in the surge of median luxury rent, which rose 17.9 percent to $11,500.

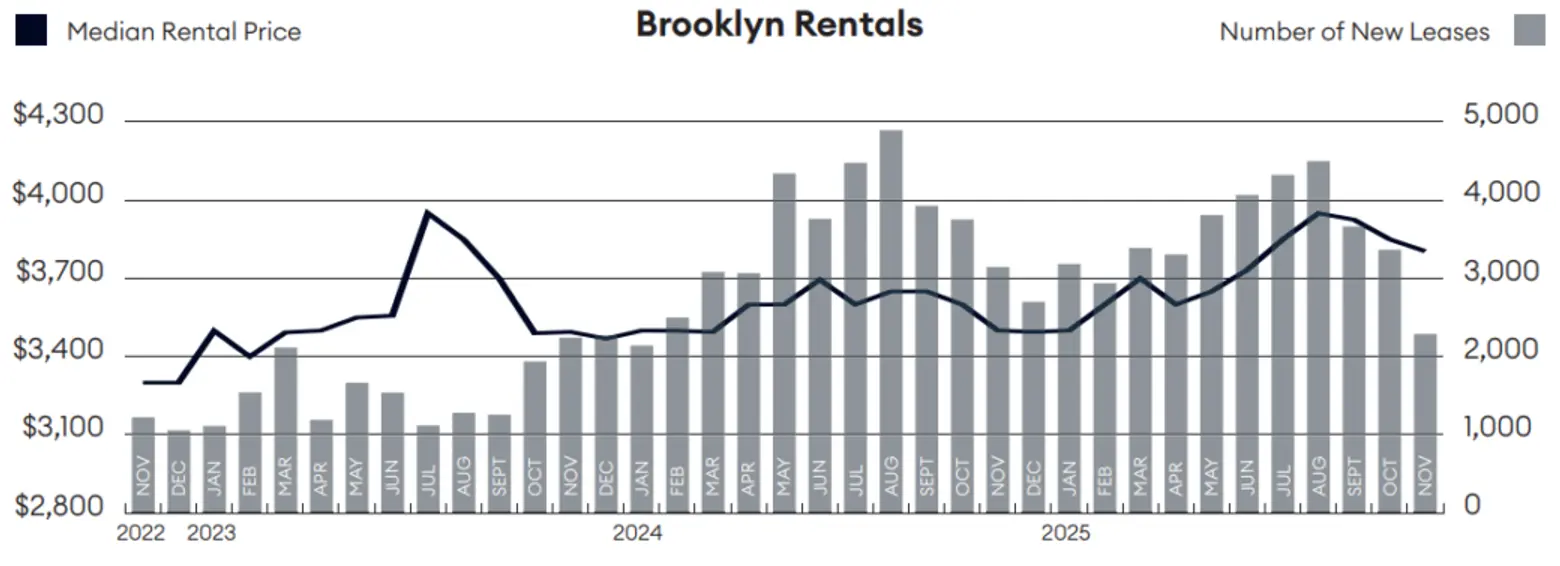

In Brooklyn, the average rent rose 8.8 percent year-over-year, from $3,925 to $4,269. The average price per square foot saw an even sharper gain, increasing 16.9 percent from $56.18 to $65.70 and setting a new record for the third straight month. Median rent also rose 8.7 percent over the year, reaching $3,804 from $3,500, the highest level since August 2023.

The upper half of Brooklyn’s market, also measured by doorman apartments, accounted for 30.1 percent of all new lease signings, a 5.5 percent increase yearly. Non-doorman apartment lease signings fell by 38.5 percent over the same period. Luxury rentals, representing the top 10 percent of listings, rose 7.5 percent annually to $7,425.

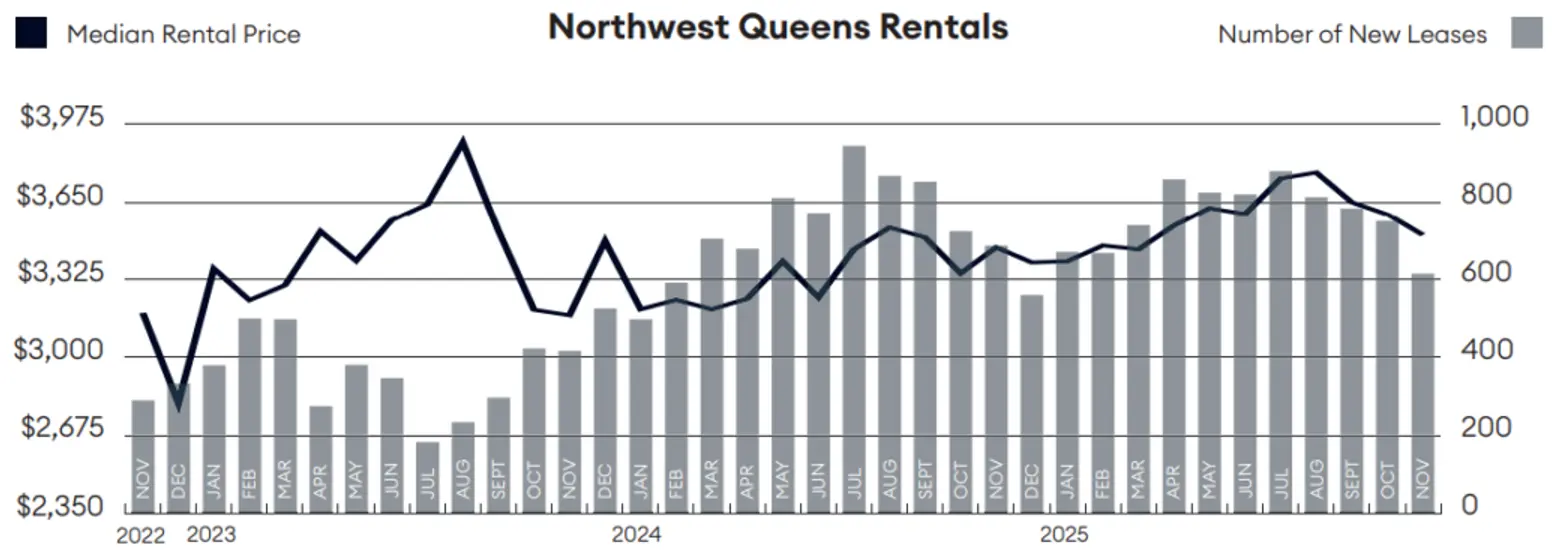

In northwest Queens, all rental price indicators rose annually even as listing inventory increased. Median rent climbed 1.56 percent to $3,510, while average rent rose 2.1 percent to $3,739. Price per square foot jumped 18.6 percent from last year to $63.80, and has risen every month since October 2024.

New signings at doorman apartments, which accounted for 42 percent of new lease signings in Queens, saw a 9.8 percent decline year-over-year, while non-doorman lease signings fell 11 percent over the same period. The entry price for luxury rentals rose 1.8 percent to $5,600, even as the median luxury rent slipped 3.3 percent yearly to $6,240.

This report calls into question a longstanding belief in the housing market: that rents usually decline when sales activity picks up, particularly for luxury properties. Instead, rents are rising, a trend that Miller says could suggest a widening gap between buyers and renters, according to Crain’s.

“There seems to be an inbound migration happening that is pulling in more wealth,” Miller told Crain’s. “I can’t really prove it, but how else would you explain that the sales and rental markets are moving in parallel? It’s unexpected.”

RELATED: