Trump is claiming a $45K tax break by calling Trump Tower his primary residence

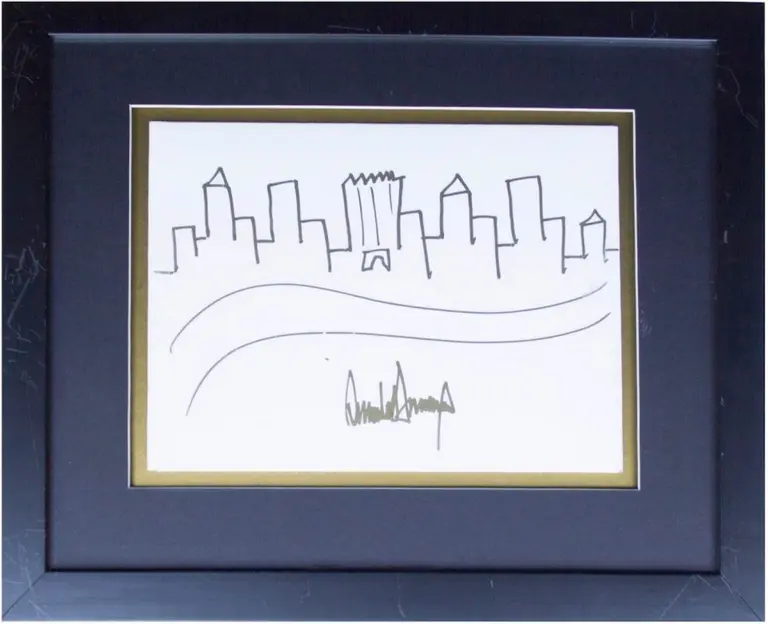

Photo of Trump Tower courtesy of Krystal T’s Flickr

While this week marks just the third time President Donald Trump has visited New York City since his January inauguration, property taxes he filed after the election designate Trump Tower as his primary residence. As the Real Deal reported, Trump will save $45,000 by calling his penthouse his main home, utilizing a tax credit known as the “coop condo abatement.” The credit can be used by owner-occupied co-ops and condos and takes off 28.1 percent of property taxes for the unit. Because of the tax abatement, the president has saved a little under $200,000 on his taxes over the last five years.

The credit reduces the property taxes for owners of cooperative units and condos because these properties are treated as commercial entities, which are taxed at higher rates than other types of housing. Owners can only claim the abatement if the units are their primary residence and if the deed is in their name. Filing for the abatement was required between December and March, with purchase of the unit required before Jan. 5 to qualify for the credit for the upcoming year. Since technically Trump Tower served as the president’s primary residence on Jan. 5 of this year, Trump’s savings of $45,000 is legal.

Living at 1600 Pennsylvania will most likely prevent Trump from benefitting from the abatement next year. While primary residency can be met through a few different means, the president won’t be able to claim it since he probably will be living at the White House full-time. As TRD learned, in 2010 President Barack Obama listed the White House as his address on his federal tax filings, but still paid Illinois state taxes on his home.

Notably, Trump’s former campaign manager, Paul Manafort, claimed the tax abatement for his condo on the 43rd floor of Trump Tower, which ended up saving him about 17.5 percent on property taxes. However, the Daily News learned in April that Manafort said his home in Palm Beach, Florida was his primary residence and was granted the abatement there too.

Despite it being against the law in New York and Florida to claim primary residency in more than one state, he filed the for the tax abatements for both residences again this year. The Department of Finance initially granted Manafort a 17.5 percent discount of $6,065 on his Trump Tower unit but has since reversed its decision. Manafort is one of the key people under investigation by the FBI, which is looking into Russian meddling in the U.S. election.

[Via The Real Deal]

RELATED: