NYC’s area median income increases by 16 percent, ‘wildly out of sync’ with actual income of New Yorkers

Photo by Emiliano Bar on Unsplash

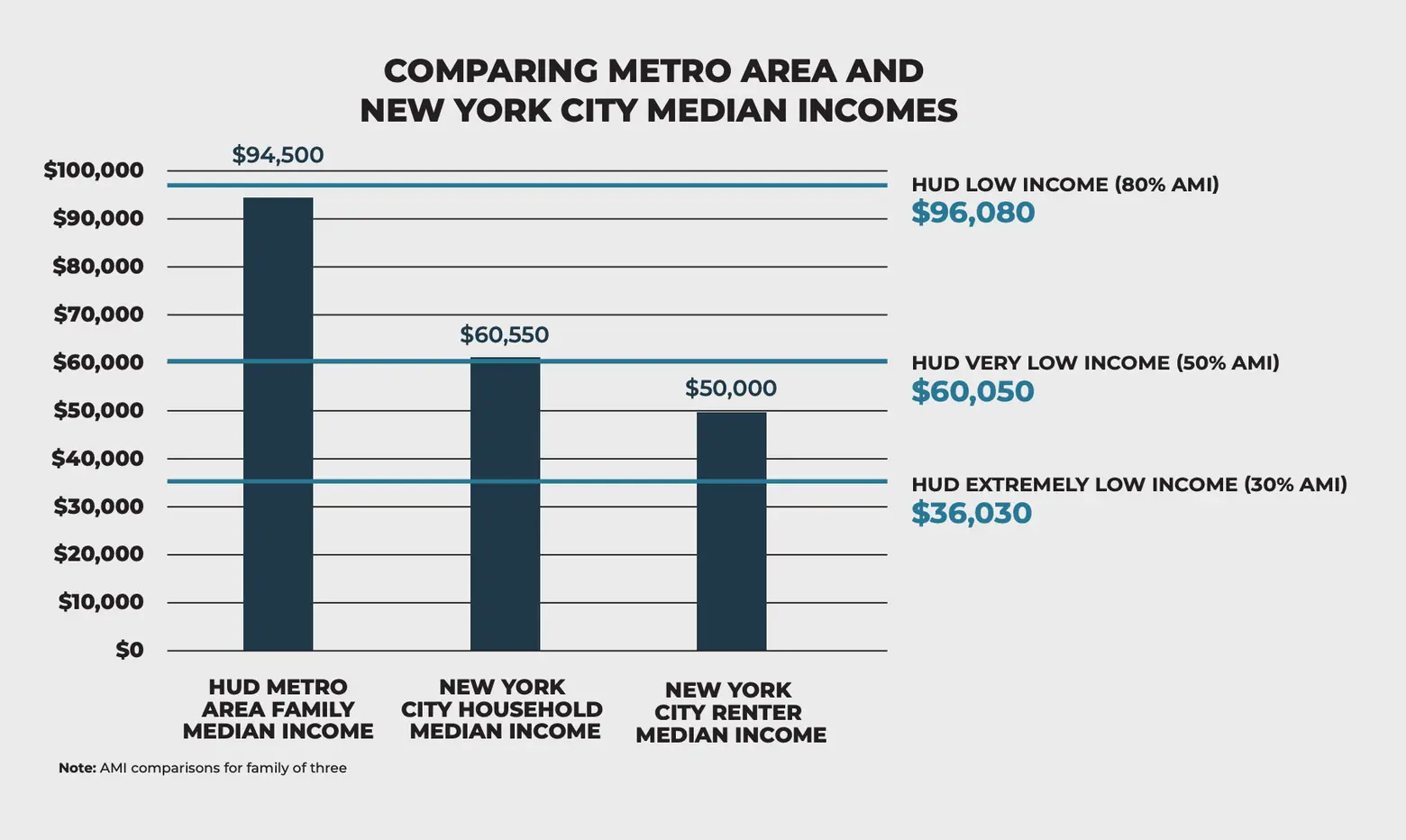

A new report highlights how the area median income (AMI) set by the federal government for New York City is “wildly out of sync” with the actual incomes earned by most New Yorkers. The New York Housing Conference (NYHC) last week released a policy brief outlining the discrepancy, citing the new AMI levels set by the U.S. Department of Housing and Urban Development (HUD) for the area. The federal government set the new median family income at $94,500 while the city’s actual household median income remains at $60,550.

Chart courtesy of NYCH

Every year, the HUD is responsible for establishing the AMIs for areas across the country. These figures are used to determine eligibility for federal housing programs and for setting affordability levels in local income-restricted housing programs, according to the NYHC’s brief.

The NYCH report shows the new AMI levels set by the HUD don’t match up with the actual incomes of New Yorkers. HUD’s AMI for the New York Metro Area increased by 16 percent year-over-year and 34 percent over the past four years.

According to the Association for Neighborhood & Housing Development, the reason AMI levels are different than actual incomes is because of the High Housing Cost Adjustment (HHCA) that HUD uses. The HHCA increases the incomes under certain AMI levels in cities where rents are high compared to incomes, which means the AMI is actually based on rental costs, not actual income.

The brief also outlines other key facts, including:

- The HUD’s median family income in the NYC metro area is almost double the actual median income of NYC renters.

- An affordable rent, or 30 percent of an individual’s income, for someone earning the HUD’s set median income, would be over $2,300, while the affordable rent for a renter earning the actual median income would be $1,250.

The new AMI set by the HUD will exclude thousands of families from affordable housing programs. According to the report, a three-person family with one adult working a full-time minimum wage job ($15 per hour) will earn an annual income of $31,200, or $403 less than the HUD’s extremely low-income standard.

United for Housing, a coalition of more than 90 organizations that advocate for affordable housing, released recommendations to help Mayor Eric Adams’ administration effectively respond to the affordable housing crisis.

UHC recommends that the city first adjust its programs and “finance term sheets” for affordable housing to include the lowest affordability levels and take into account the rising AMI levels that don’t reflect the actual incomes of New Yorkers.

Other recommendations include the city producing more affordable housing for households earning less than $50,000 and setting “minimum production targets” for deeply affordable housing.

In response to the recommendations outlined in the report, the Adams administration said it was committed to creating affordable housing for New Yorkers who need it most.

“While AMI levels are set by the federal government, the administration has taken significant steps to create this much-needed housing.” William Fowler, HPD press secretary, said in a statement. “Making the largest affordable housing investment in the city’s history at $22 billion, accelerating the creation of supportive housing, unlocking $10 billion for repairs for NYCHA residents, and eliminating the overall unit count metric that disincentivized the creation of deeply affordable homes.”

The Adams administration in July released their housing blueprint plan that set policy goals and laid out improvements that would help the city tackle its housing crisis, but it did not include the framework for affordability levels.

“The data clearly shows a major discrepancy between what every day New Yorkers are experiencing financially and how the federal government sets income standards,” Rachel Fee, executive director of the NYHC and organizer of the United for Housing coalition, said.

“At the same time, City Hall can take this opportunity to start building housing where the need is greatest – for renters earning under $50,000 and establish minimum production targets for New Yorkers who need it most.”

RELATED: