NYC property tax has risen disproportionately for working-class homeowners, report finds

Photo by Rachel Martin on Unsplash

Property tax in New York City has risen since the pandemic, with most of the burden placed on working and middle-class homeowners, according to a report. State Comptroller Thomas DiNapoli on Wednesday released a new report that found property tax bills have continued to increase, despite property values decreasing for a large number of condos, co-ops, and rental apartments across the city. According to DiNapoli, the way the city calculates property taxes makes lower-valued properties pay a higher property tax, putting a bigger burden on lower-income New Yorkers and less on the wealthy.

In NYC, different types of properties receive different tax rates, including single or multi-family homes with more than three residences. For co-ops and condo units, the city doesn’t calculate property tax based on market value and how much they’ve previously sold for; instead, it prices them based on similar apartments, including rent-stabilized units and residences in buildings that receive tax exemptions.

Increases to market value are also limited by yearly and five-year caps that vary based on the type of property. Due to these caps, a lower-valued home that continues to lose market value doesn’t necessarily mean it will have to pay lower property tax. In fact, many of the city’s lower-valued homes have to pay a far higher property tax than some of the five boroughs’ most expensive properties.

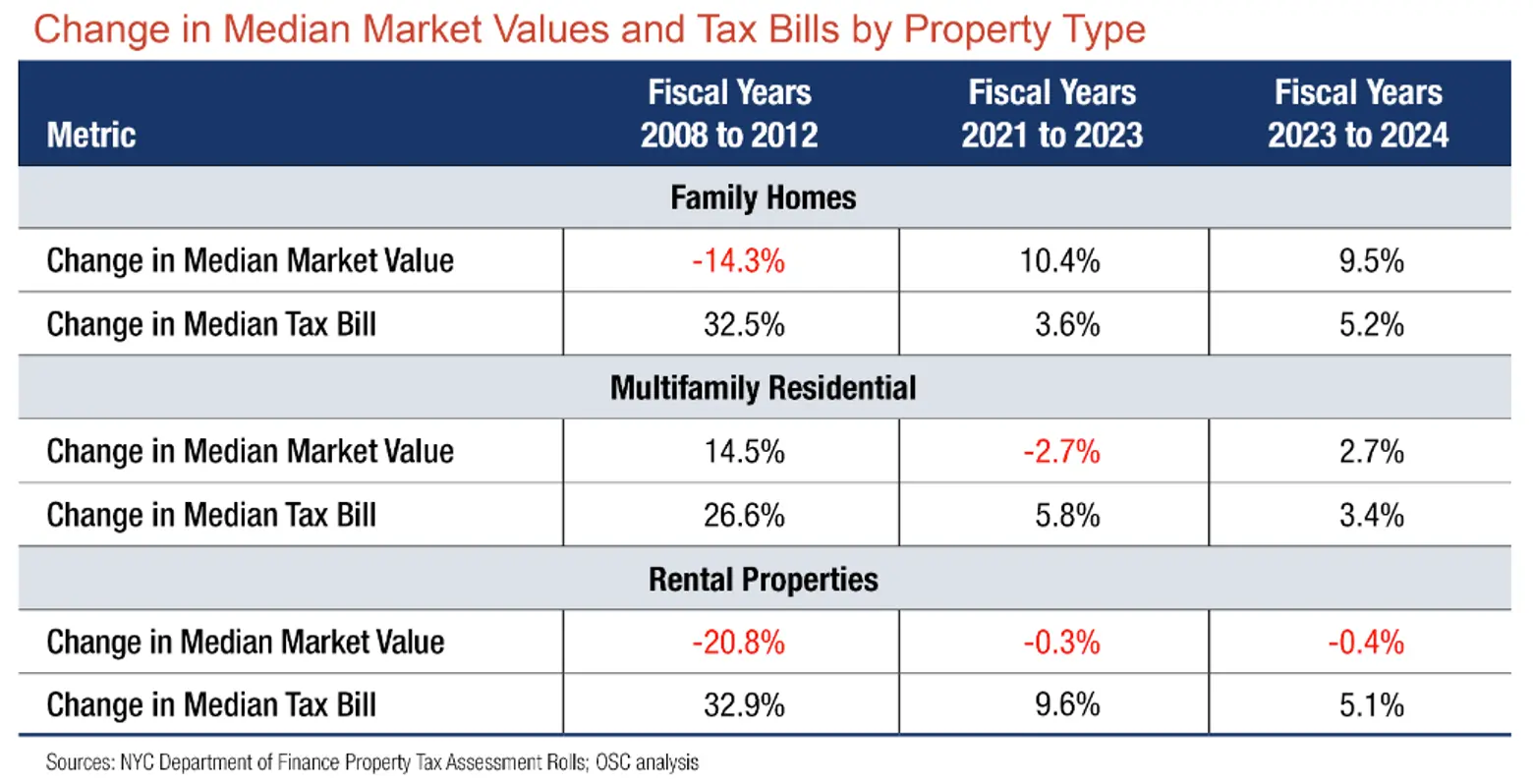

During the 2008 recession, the median market value for family homes decreased to 14.3 percent while the median tax bill increased by 32.5 percent. A similar instance occurred during the pandemic, when the median tax bill increased by 5.8 percent from fiscal years 2021 through 2023, despite the median market value for multi-family properties decreasing by 2.7 percent. For rental units, taxes rose by 9.6 percent while their market value decreased by 0.3 percent, according to the report.

DiNapoli found these differences were even greater from fiscal years 2007 through 2024. During this time period, the gap in taxes based on property value continued to increase, with the median tax bill for NYC’s most expensive family homes growing by 131 percent, while the city’s least expensive homes grew by 149 percent.

New York City renters are also affected by the tax system despite not owning their homes, as landlords will pass on the cost of the tax to tenants. Over the course of the pandemic, rentals in the top 20th percentile saw their market value decrease by 2 percent and tax bills increase by 2.1 percent, while rentals in the bottom 20th percentile saw their value rise by 1.7 percent and tax bills increase by 11 percent.

DiNapoli recommends that city and state officials take the following course of action to address these disparities in property tax, including:

- Accounting for how residential property taxes respond to changes to the economy in order to avoid worsening existing issues.

- Revisiting the Advisory Commission on Property Tax Reform’s recommendations to reform the current tax system while keeping the same level of total tax collections.

- Addressing the city’s lack of affordable housing, including using tax incentives to motivate new developments.

“New York City’s residential real estate market has proven resilient to the pandemic as prices remain strong,” DiNapoli said. “This benefits the city because property taxes account for about 45% of the city’s revenue.”

“However, property tax disparity has gotten worse since the pandemic, which is concerning because it’s driving up housing costs for those less able to afford it, and at the same time, the city faces a shortage of affordable housing. A recalibration of the process used to determine tax bills is needed if the city wants to remain accessible to working- and middle-class families.”

RELATED:

Interested in similar content?

Leave a reply

Your email address will not be published.

Let’s work on legislation to adjust property tax according to market value .,Not location of where it is in the city… A fair share by all .. The American way…Thank you for the Efforts moving forward for our long time nyc citizens…..