Americans Are Spending More on Rent and There’s No Relief in Sight

Complaining about high rents is nothing new for New Yorkers, but we’re actually not alone in our misery. According to a new study from Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners, reported in the Washington Post, “nearly 15 million [U.S.] households could be ‘severely cost-burdened’ by 2025, meaning they’ll be spending more than half their money on housing.” Today, that statistic applies to 11.2 million households (one in four households), which increased by three million since 2012.

The staggering rise can be attributed to “temporary” factors such as low home-ownership rates after the housing bubble burst, followed by a construction rate that couldn’t keep up with population growth thanks to the recession, which also put a strain on families’ budgets. But the Wall Street Journal also points to long-term population trends. For one, “Hispanics tend to be disproportionately renters and are more likely to pay a large share of their incomes in rent, thus putting more pressure on the existing supply of affordable rental housing.” Snake People are the other group challenging the rental supply–”Many of those young adults entered the job market during and after the recession, meaning many were unemployed or underemployed for crucial early years of their careers, and are more likely to struggle to afford housing.”

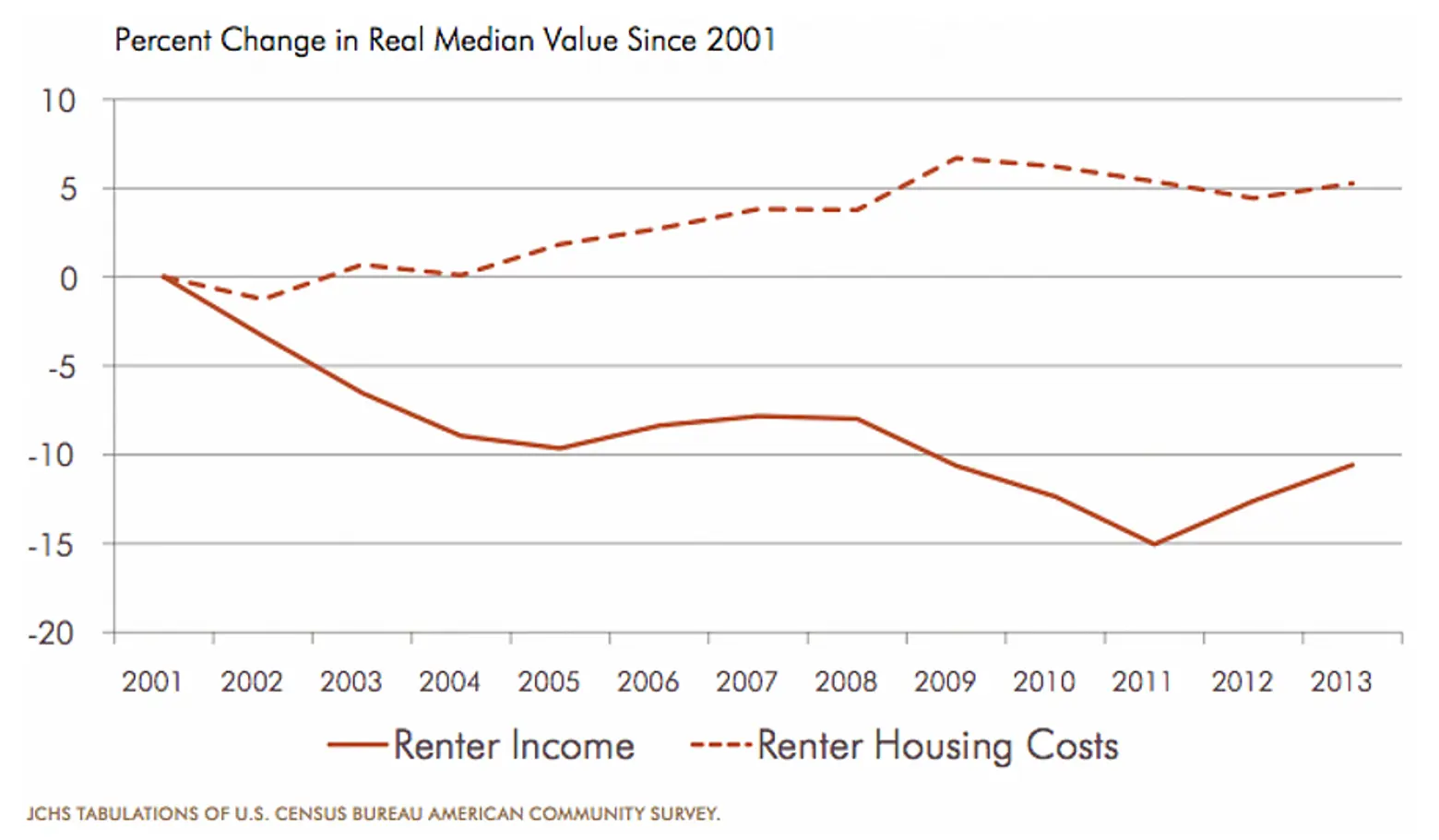

Chart via Enterprise/Harvard JCHS

Rents have been growing faster than incomes for the past 15 years, but even if this were reversed, the study finds that it would still take well over a decade to see the rental market significantly improve.

RELATED:

Get Insider Updates with Our Newsletter!

Leave a reply

Your email address will not be published.

My wife and I were priced out of our apartment which was the cheapest in town at the time and was (and still is) run by a slum lord who refused to fix the backed up plumbing (on the second floor, the first floor was uninhabitable as it was constantly under sewage). The excuse has been that theres so many oil wells operating around town that the demand is driving the price anual increases, except for the fact tha the wells have been steadily closing and their operating companies going out of business and leaving town yet the prices keep going up and up. We live in my wifes childhood bedroom at my inlaws house. We keep saving to try and move out but every time it looks like we’ll be able to afford to move out, the prices go up again and we’re back to square one.