How Would a Minimum Wage Hike Change the Way New Yorkers Spend Money?

Today, the Daily News reports that increasing the minimum wage to $15/hour would add $10 billion annually to city paychecks and increase earnings for almost 1.5 million people, according to an analysis by City Comptroller Scott Stringer. Says the paper, “The typical family getting the boost would spend $1,100 to $1,800 more a year on housing, and up to $600 on groceries, $400 on entertainment, and $300 eating out, Stringer predicted.”

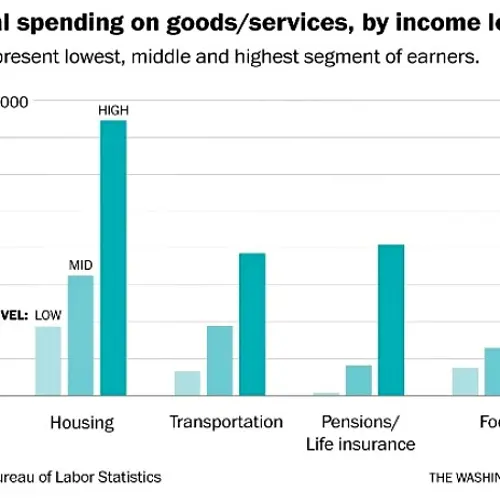

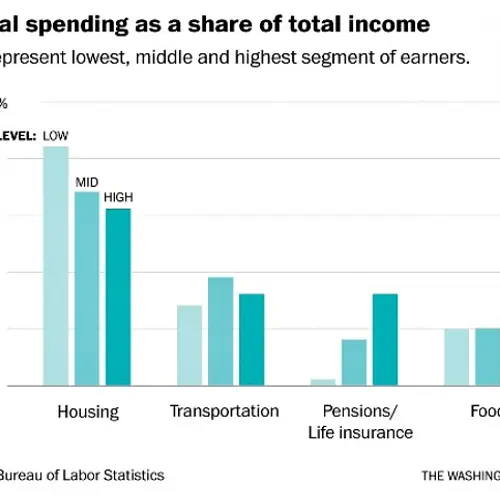

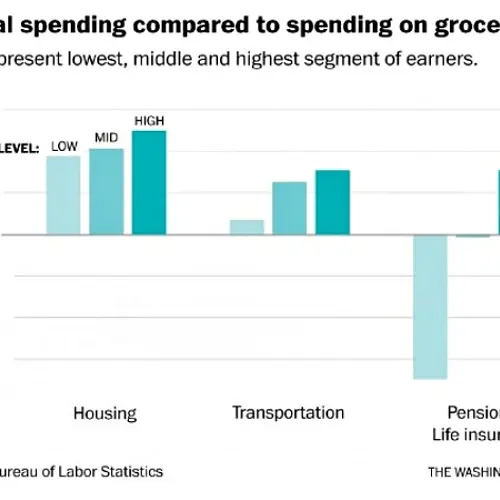

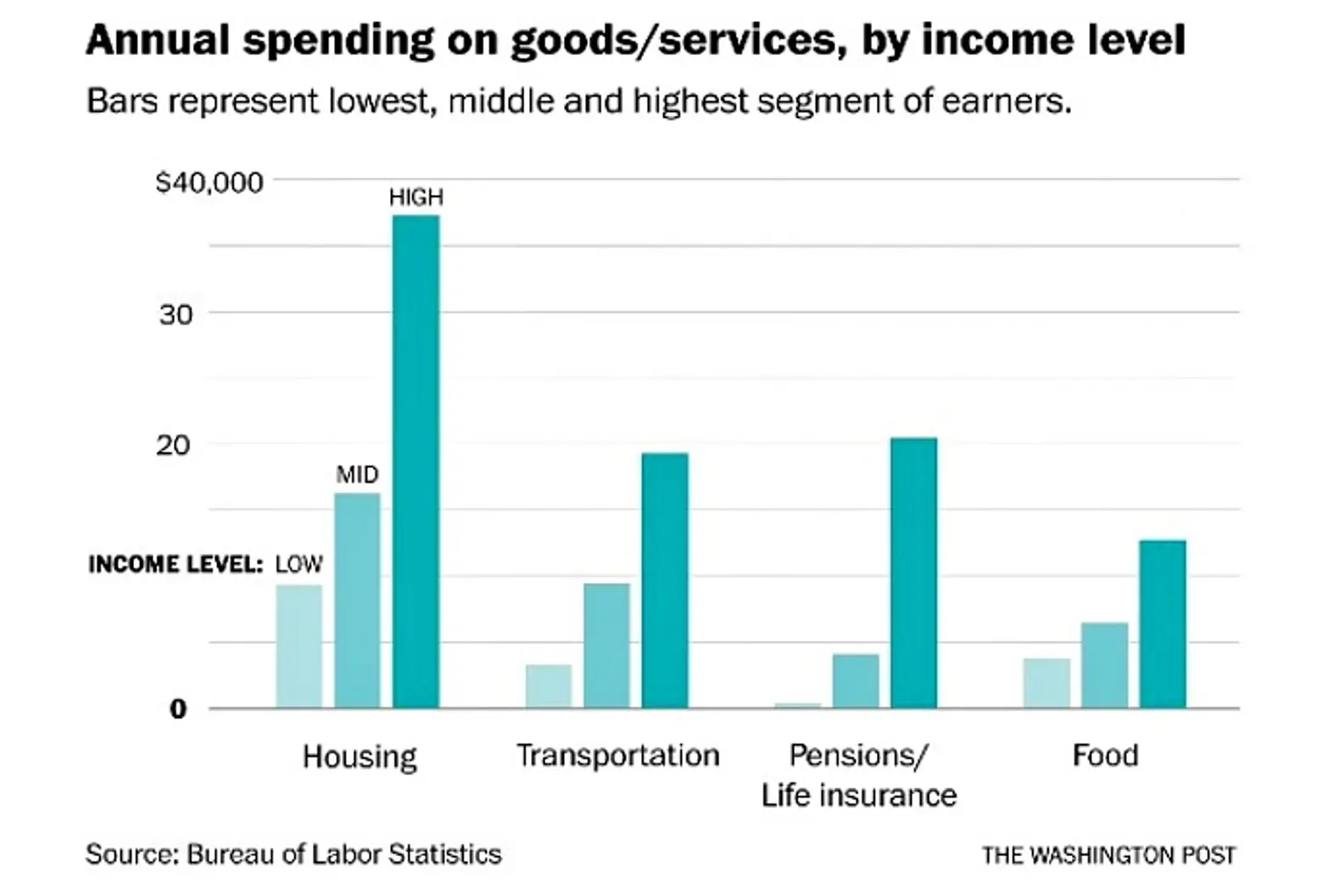

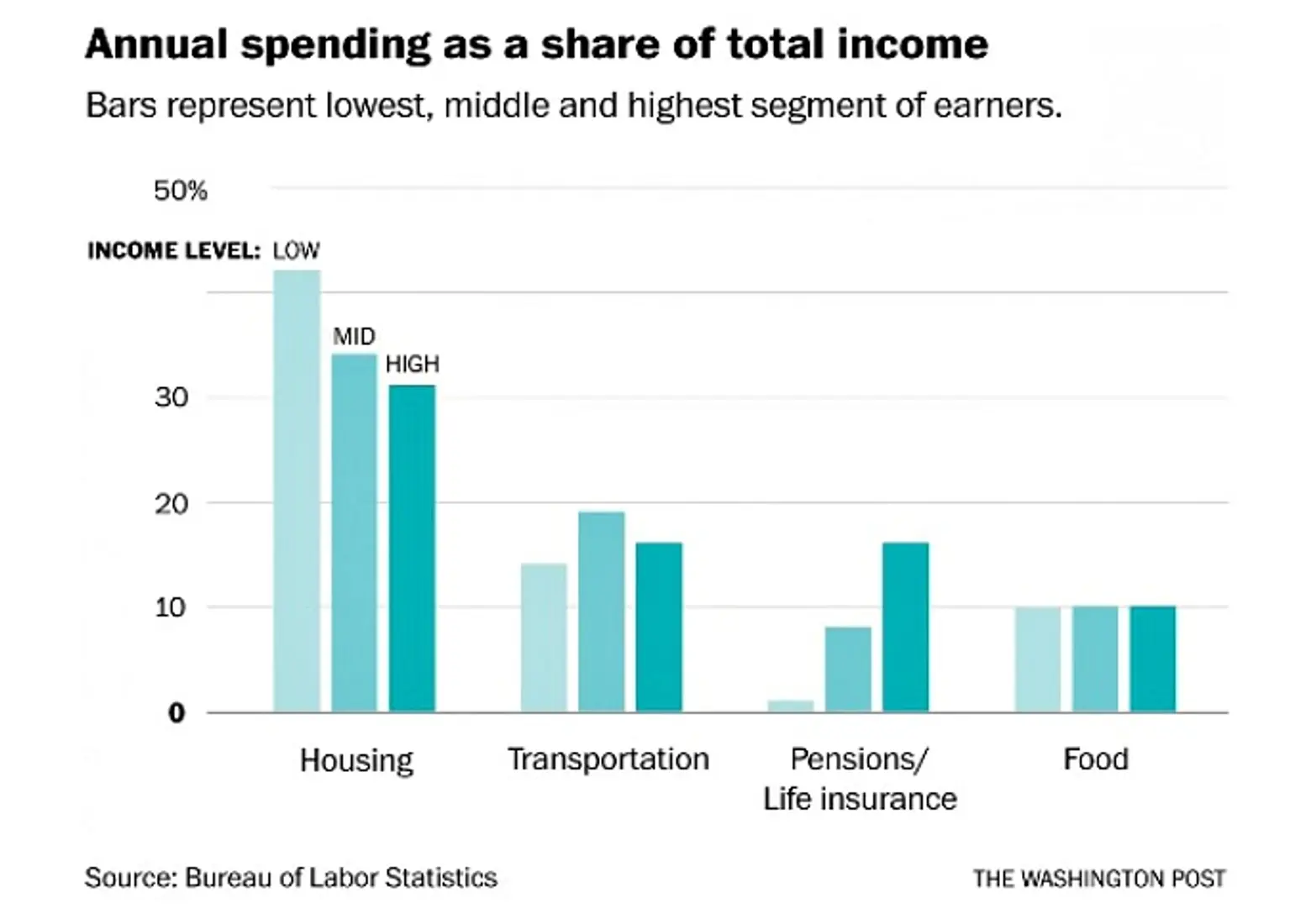

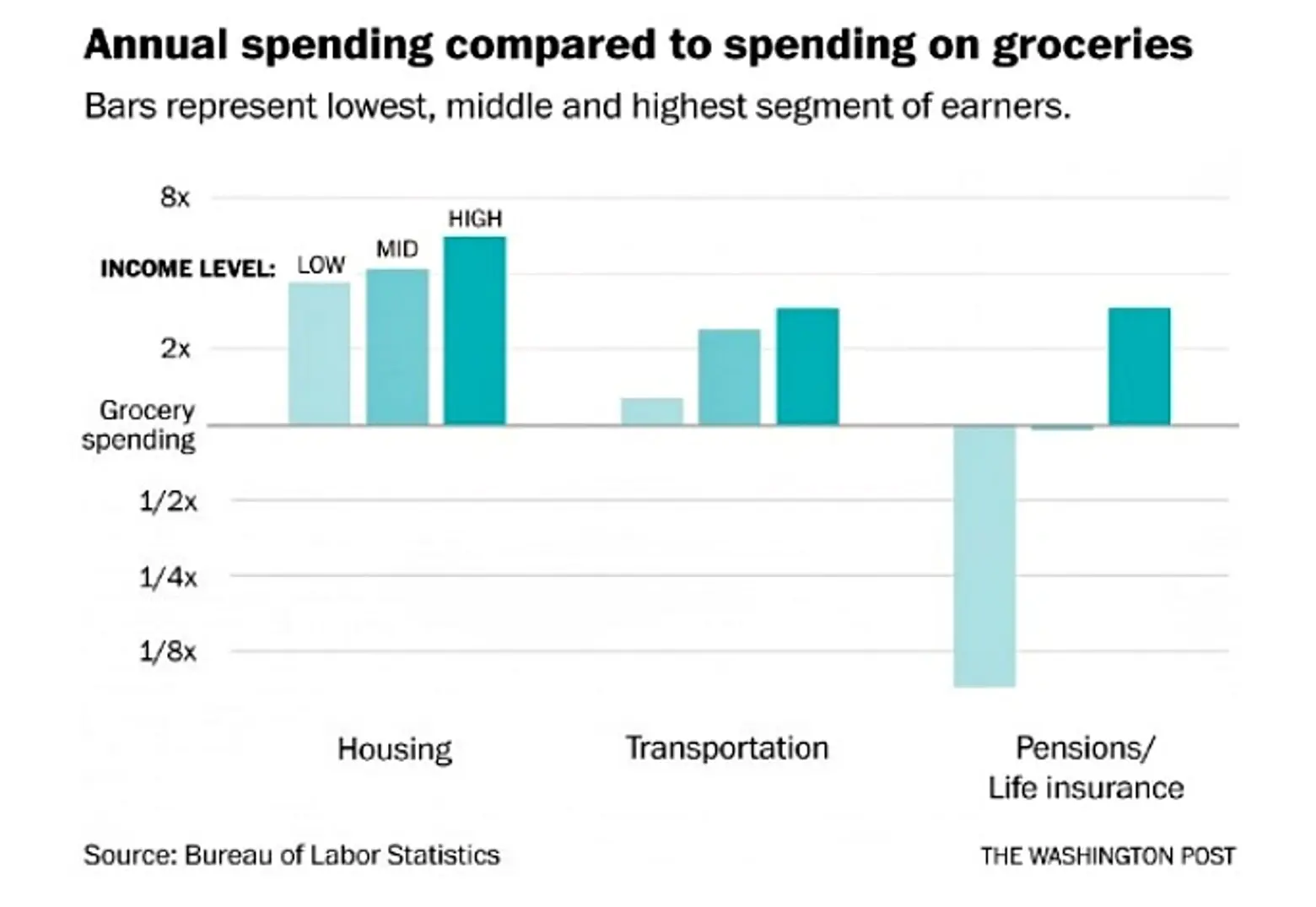

How would this increase in spending compare to a given family’s financial patterns before the minimum wage hike? The Washington Post has used newly released data from the Bureau of Labor Statistics to analyze where the poor and rich spend really spend their money. Looking at four categories (housing, transportation, food, and pensions/life insurance) and three classes (low, middle, and high), the results are mainly as to be expected. The rich spend more all around, but as a percentage of their total income, they spend less; the middle class spends the most on transportation; and basically all Americans have similar spending patterns when it comes to groceries. But the big difference between the upper and lower classes is saving. “For every dollar they spend at the grocery store, the poorest households save 12 cents, while the wealthy sock away $3.07 in pensions and life insurance.”

Interestingly, the data shows that all three income levels “spend about 19 percent of their grocery budget on fruits and vegetables, about 22 percent on meats, and about 13 percent on breads and cereals,” as reported by the Washington Post. Less surprising is the fact that the rich spend more money dining out and attending events.

The disparity in saving has economists concerned, as the Post explains:

The rich save more than the poor, and the more they have, they more they’ll save. Money that’s being saved isn’t being spent, which means less business for everyone from the dry cleaner on the corner to the owner of a five-star hotel. In turn, that means less work for everybody and a lethargic economy.

Along these lines, Stringer predicts that by raising the minimum wage in New York City to $15, taxpayers would save $200 to $500 million a year in food stamp and Medicaid costs, and the number of New Yorkers spending half their income on rent would be reduced by 90,000.

[Via Washington Post and NYDN]

Charts © Washington Post

RELATED:

- New Maps Show How Much You Need to Work in Order to Own a Home in NYC and Other Major Metros

- Are You Considered ‘Middle Class’ in NYC?

- New Report Shares What You Need to Earn to be Considered ‘Rich’ in Your City

- Here’s a Map of Where the World’s Insanely Rich Live

- Owner of $100M Apartment at One57 Only Pays $17,268 in Property Taxes