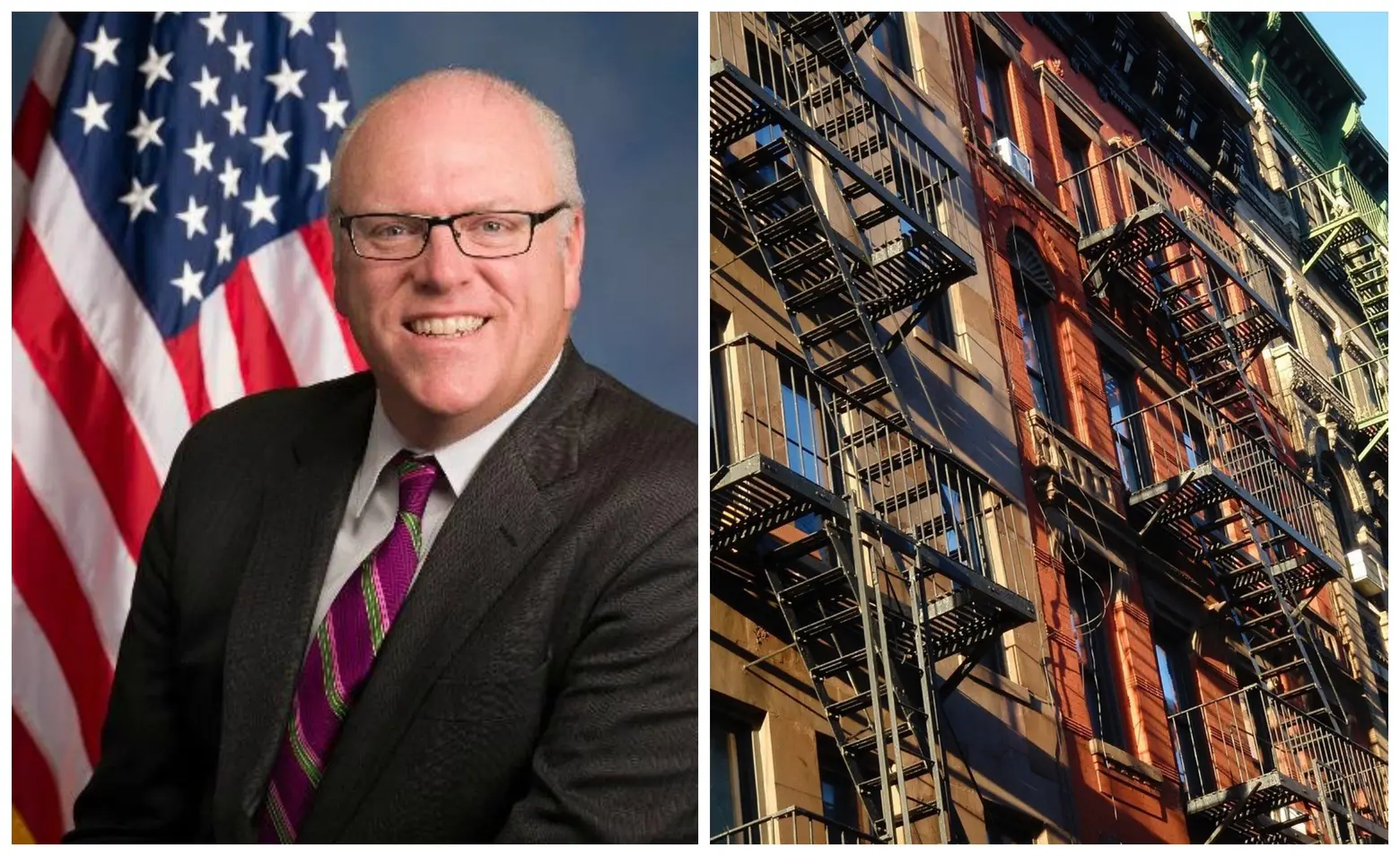

Congressman introduces bill that would offer tax credits to rent-burdened Americans

Rep. Joeseph Crowley announced federal legislation this week that aims to create two refundable tax credits for low- and middle-income renters. For rental households across the U.S. with incomes of $125,000 or less, the Rent Relief Act would provide them with one of two tax credits, if the bill becomes law. According to the Democratic congressman, who represents part of the Bronx and Queens in New York’s 14th congressional district, roughly 111 million Americans live in rental housing, with about two-thirds of all households in New York City currently renting, twice the national average.

The legislation would provide resources directly to struggling individuals and families in rental housing by offering two different types of tax credit. First, individuals living in unsubsidized rental housing as their primary residence and paying more than 30 percent of their income in rent would be eligible for a refundable tax credit. The second offers those living in government-subsidized rental housing the option to claim the value of one month’s rent as a refundable tax credit. Crowley, who chairs the Democratic Caucus and Queens County Democratic Party, said the affordable housing shortage hurts both the working poor and middle-class families.

“Unfortunately, the demand for rental housing continues to outpace supply, and while all signs point to higher rents in the future, wages remain stagnant,” Crowley said at a press conference in Queens on Monday. “Just as the tax code has helped make homeownership more affordable, I believe Congress must provide relief to the growing number of renters who are feeling squeezed financially.”

Crowley is introducing this legislation at a time when the U.S. is going through an extreme lack of affordable housing. As 6sqft covered back in March, a report by the National Low Income Housing Coalition (NLIHC) shows extremely low-income renters face a shortage of affordable housing in every state and major metro area in the country. Only 35 affordable housing units exist per 100 extremely low-income homes (ELI homes) and in the New York metro area, this number drops to 32 units per 100 households. According to NLIHC, 71 percent of ELI renters household spends more than half of their income on rent and utilities.

The Rent Relief Act has been backed by NY State Assemblyman Brian Barnwell and NYC Council Majority Leader, Jimmy Van Bramer. During the press conference introducing the bill, Councilman Bramer said, “This tax credit spearheaded by Congressman Crowley would be life changing for millions of New Yorkers, bringing much needed financial relief and a boost to our local businesses.”

[Via Curbed NY]

RELATED: